Former member of the board and shareholder of JSC “AK Bank” Viktor Khenkin, nephew of the famous Samara businessman Alexander Khenkin, was declared bankrupt by the decision of the Moscow arbitration. The court opened the procedure for the sale of the debtor’s property for a period of three months, according to the file of the court. The verdict is still subject to appeal.

Recall that the first stage in the reorganization procedure – the restructuring of debts in relation to Khenkin was introduced in May 2021. Valery Bakin, a member of the SRO SEMTEK union, was appointed financial manager. The register also included the claims of “Trust” – 110,173,352.25 rubles of the main debt, 3,931,788.27 rubles of interest, 6,082,607.42 rubles of a penalty and 1,107,332.34 rubles of a fine.

During this time, the creditors of the former head of the board of Rost Bank included Citibank and Russian Standard Bank.

In July 2018, the legal procedure for the merger of Rost Bank JSC with Trust Bank was completed. Earlier, Khenkin was charged in absentia with organizing an organized criminal group; since 2018, he has been on the international wanted list.

In addition, Trust Bank filed lawsuits with the Moscow Arbitration Court to invalidate transactions to increase the authorized capital of LLC Rost Investments due to an additional contribution in the amount of 205 billion rubles and LLC Rost Capital in the amount of 49.9 billion rubles. The defendants were subsidiaries of Rost Bank.

According to the plaintiff, transactions to increase the authorized capital of subsidiaries are invalid, since they are transactions with an unequal counter provision. They are aimed at withdrawing the assets of Rost Bank to companies controlled by the former president of Binbank and the owner of Rost Bank, Mikail Shishkhanov.

On July 1, 2019, the courts of appeal declared the transactions invalid. The court also recovered from the defendants in favor of the bank “Trust” funds in the amount of 205 billion rubles and 49.9 billion rubles.

At the end of December 2014, the Central Bank of the Russian Federation decided to sanitize Trust with the help of the DIA. Otkritie FC bank was chosen as a sanatorium, which received 127 billion rubles at the end of the year for the sanation of Trust.

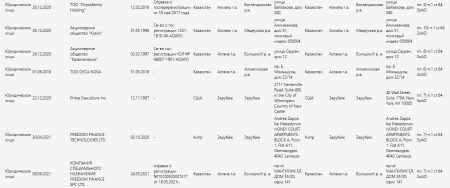

To date, Khenkin does not have any business assets listed in the Unified State Register of Legal Entities. As they say, a goal is like a falcon.