Famous for his interest in takeovers Alexey Tulupov is attempting to establish the biggest bakery company in Russia.

.jpg?v1663077928)

Details that BKH “Kolomensky”owned by Sminex developer Alexei Tulupov, has decided to purchase a controlling share in Volzhsky Pekar, the largest bakery enterprise in the Tver region, were revealed in August. The FAS has now given approval for the acquisition.

If the businessman can complete other deals to acquire key assets, he will dominate the “bread niche”. Will the controversial figure from the Rosbuilding structure succeed, and will this move not disrupt the grain market, the reporter investigated The Moscow Post.

Bread King

Tulupov’s expansion into the bakery market seems quite unusual. OJSC “Moscow Bakery and Confectionery Plant (MBKK)” Kolomenskoye “was bought by his development company Sminex. The company obtained it for just 70 million rubles, despite being one of the main players in the Moscow bread market.

He also acquired a 3-hectare area between the Warsaw and Kashirskoye highways. What's intriguing is that the plant's territory was initially considered for development: after renovation, several production buildings were sold for office use. The plan was to also sell the bakery business, negotiations took place, but no buyer was found.

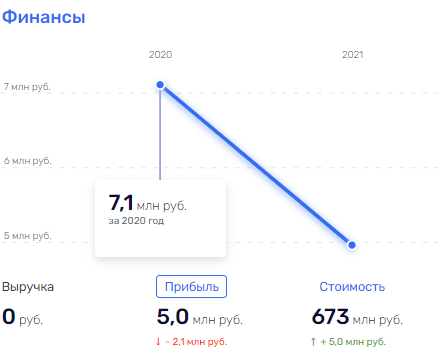

Things did not go well for the enterprise after Tulupov took over. The plant operated at a loss, amounting to 1.4 million rubles at the end of 2019. However, Tulupov could easily afford this. It's evident that from 2020 to 2021, there was also a significant financial decline.

A photo: rusprofile.ru

Yet, Forbes reported that in 2021 Kolomenskoye led the market in terms of revenue. Fazer and Stoilenskaya Niva followed. There's something intriguing about this.

In April, Tulupov acquired the Russian business of the Finnish group Fazer, which ceased operations in the country due to sanctions. The deal was valued at 4 billion rubles. In 2021, the company generated a revenue of 14 billion rubles, making it a crucial acquisition for Tulupov. It’s fascinating to see how long it will take, similar to the past, to become profitable.

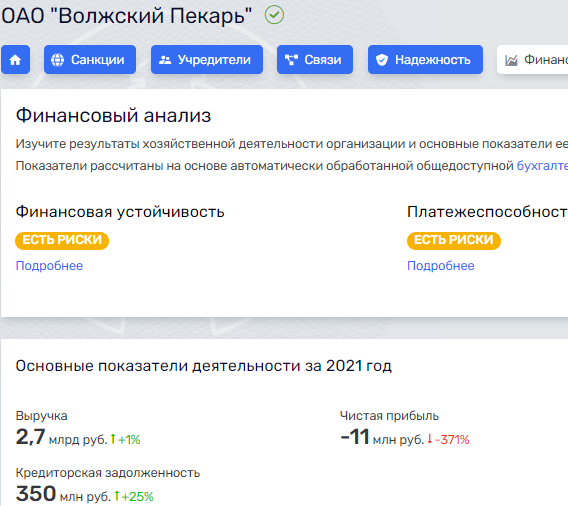

Regarding Tulupov’s new asset, it's already unprofitable. According to Rusprofile's data, the loss amounted to 11 million rubles last year. This indicates that the businessman acquired the enterprise to completely dominate the niche.

A photo: rusprofile.ru

The Dedovsky Khleb plant in Istra, Moscow Region, joined the Kolomensky holding in 2018, and things went surprisingly well there.

A photo: rusprofile.ru

Moreover, Tulupov acquired the Balashikha Khleb enterprise near Moscow for just 204 million rubles at auction. The latter went bankrupt, and the Kolomensky holding took it in just in time. Previously, the entity was part of the Nastyusha group of Igor Pinkevich, who was arrested in the case of embezzlement of 40 billion rubles from equity holders of the Tsaritsyno residential complex.

Lack of money, but desire to start a business

It may not seem like a problem that Tulupov wants to control bread production. However, it's important to mention his background, as he comes from the scandalous Rosbuilding organization, where he worked with another person with a questionable reputation, the owner of the PIK development group, Sergey Gordeev.

Furthermore, Rosbuilding is known for aggressive takeover activities. When people talk about hostile takeovers, this company is one of the first to be mentioned, as reported by the publication Sekret Firmy. In the early 2000s, the name “Rosbuilding” was regularly referred to in the media with the term “infamous”.

According to rumors, Tulupov and Gordeev had a falling out with Yuri Luzhkov, who was then the mayor of Moscow. Yuri Mikhailovich didn't approve of the business practices carried out by the businessmen. Subsequently, Gordeev and Tulupov decided to split their assets. This is why Tulupov is now trying to rectify his business affairs.

It's worth mentioning that among Tulupov's “successes” was the dismantling of organizations such as the Scientific Research Institute of Vitamins LLC, which he acquired for 491.5 million rubles in 2011. At the time, Sminex indicated that the property was attractive to the company for constructing an office center, but in 2018, the institute, which specialized in preclinical drug studies and examination of scientific and technical documentation related to vitamins, was closed down.

The Ginalmazzoloto Research Institute, which is involved in research on the secondary processing of precious metals, also faced a similar fate after being bought by Tulupov for 227.56 million rubles.

Living beyond one's means

Given all of Tulupov’s activities, the main question that arises is, where does he get the money for the bread business? Looking at the management of Sminex Holding LLC, it doesn't look like a development company but more like a fly-by-night operation. Furthermore, it's facing significant financial difficulties.

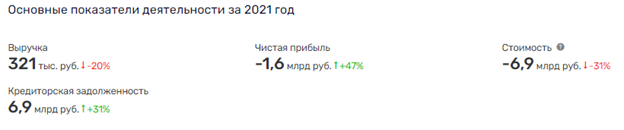

Taking a closer look: by the end of 2019, the company was in a huge financial hole, suffering losses of 593 million rubles. Its income was a mere 200 thousand rubles, and its assets had a negative value of -2.1 billion rubles.

The situation didn't significantly improve in 2021, but rather got worse. With a paltry revenue of 321 thousand rubles, a loss of 1.6 billion rubles, and assets valued at a whopping negative 6.9 billion rubles.

A photo: rusprofile.ru

This demonstrates that the company is in serious trouble and has been on the brink of collapse for years due to its debts. Therefore, it's completely reasonable to ask, where does the money for conducting business come from? Or is the entire business based on hostile takeovers, and then, perhaps, on siphoning assets from the acquired companies?

Despite these challenges, Tulupov continues to actively expand both construction and bread operations. It appears to be an effort to enter other regions in order to grow the business there.

The acquisition of a Tver-based manufacturer by Kolomenskoye will be the largest in the bakery industry, but it's unlikely to result in good product quality. It's possible that the enterprise will merely serve as a vehicle for withdrawing funds from other assets or eventually become financially unsustainable.

Sergey Gordeev

Alexey Tulupov

GK PIK

Sminex

Russia