According to the Central Bank, in December the volume of bad corporate debt in Russian banks fell by 104 billion rubles. (minus 3.4%), up to 2.93 trillion rubles.

The quality of the portfolio improved significantly in July 2021 (by 265 billion rubles) when Sberbank sold shares and debt of the Eurocement group. The Bank of Russia mentioned that the December result was influenced by “write-offs of large loans at the expense of reserves,” but did not reveal details.

Otkritie Bank, owned by the Central Bank, improved the industry's performance, according to RBC. In December, it was the leader in reducing corporate delinquency, with the volume of problem loans on its balance sheet decreasing by almost a third, or by 45.3 billion rubles, to 92.5 billion rubles, as of January 1. In comparison, in Sberbank and VTB, delinquency on loans to legal entities, excluding reserves, decreased by 13.3 billion rubles and 12.1 billion rubles, respectively, over the same month.

“The significant decrease in corporate delinquency in December was primarily due to the write-off of the fully reserved debt of a private company. We are talking about a loan that arose before 2018,” a representative of Otkritie told RBC. The bank declined to disclose the amount of the loan and the borrower.

What had to cover “Opening”

According to Otkritie's turnover sheet, problem debt on loans issued to non-state financial organizations decreased most noticeably in December. The balances on this account decreased by 32.5 billion rubles, or by 77.7%, to 9.3 billion rubles. Another 8.2 billion rubles delinquency on loans approved to non-resident legal entities decreased. As of January 1, the volume of such bad debts on the balance sheet of Otkritie amounted to 20.4 billion rubles, having decreased by 28.5% over the reporting month. Bad debts of private companies to Otkritie over the same period decreased by only 4.7 billion rubles.

Overdue debt decreases at the same time as accrued reserves, explains Anton Lopatin, director of the analytical group for financial institutions Fitch. According to Otkritie’s financial statements, this is exactly what happened in December: the volume of reserves for possible losses on loans decreased by 45.8 billion rubles, covering the change in delinquency.

The write-off concerns debts recognized as uncollectible, reminds the managing director of the NKR rating agency Mikhail Doronkin: “The write-off occurs after passing all the formal collection procedures and obtaining the relevant court decisions, which may take more than one year. It is assumed that by the time of writing off the creditor has made every possible effort to repay the debt or sell the debtor’s property.

From the previously published balance sheets of Otkritie, it follows that bad debt on account 45811 increased sharply in November 2017 (by 11.1 billion rubles, or nine times), as well as in March 2018 (by 28.8 billion rubles, or three times) – that is, around that time the borrower stopped paying. Since then, the balances on this account have increased symbolically, but monthly due to accrued interest. And the debt itself, before becoming problematic, could have formed in August 2017 – in that month, the requirements of Otkritie Bank to non-state financial organizations for a period of three years (account 45108) jumped 4.6 times, to 94.4 billion rubles.

On August 29, 2017, the Bank of Russia announced that the Otkritie group, led by the bank with the same name, would be reorganized. Before the financial recovery started, Otkritie Holding, whose main beneficiary was Vadim Belyaev, was the main shareholder. The new owners of the group are still arguing about a bunch of transactions that happened just before the bank was reorganized.

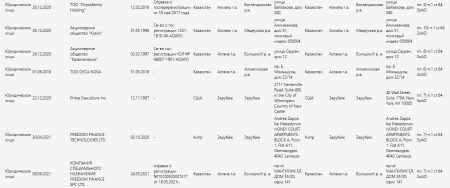

What debtors is Otkritie suing after reorganization

Otkritie is in a dispute for $700 million in the High Court of London with structures of O1 Group of Boris Mints. Otkritie and Trust, which received most of the non-core assets of the rehabilitated banks, filed the lawsuit. According to state banks, in August 2017, Otkritie and Rost-bank bought bonds of the SPV company O1 Group Finance for 57 billion rubles. And Mintz’s O1 Group used this money to repay its own loans to two banks. Lenders ended up losing secured loans and receiving illiquid bonds. The lawsuit was filed against Boris Mints and his three sons. In August 2020, three more defendants appeared in the same case – the former co-owners of Otkritie and Binbank Vadim Belyaev and Mikail Shishkhanov, as well as the ex-head of Otkritie Yevgeny Dankevich.

The case has not yet been completed. A similar dispute with the companies of Mintz was considered in the London Court of International Arbitration (LCIA). In November last year, Trust initiated a procedure for the recognition of the decision of this court in Russia, since the court, according to it, “recognized the so-called replacement transaction as fraudulent.”

Lawsuits against the ex-owners of Otkritie. In 2019, the Central Bank and Otkritie filed a claim with the Moscow Arbitration Court against Belyaev and other former owners of the bank, including Otkritie Holding, for 289.5 billion rubles, the court satisfied it. Otkritie and Trust tried to recover money from Belyaev in a US court, where he left after the reorganization, but he refused to consider this case.

Lawsuits against the former owners of the rehabilitated Binbank, whose assets were also transferred to Otkritie. The Central Bank demands from the former co-owner Mikail Shishkhanov, as well as top managers of the bank, 284 billion rubles, another 330 billion rubles. Trust wants them.

What will give Otkritie a write-off of bad debts

In August last year, the Central Bank announced the resumption of preparations for the sale of shares of Otkritie Bank. The regulator is considering two scenarios for exiting the asset – the sale of 50% plus one share to a strategic investor or the initial public offering (IPO). At the end of December, the head of Otkritie, Mikhail Zadornov, said in an interview with the Rossiya 24 TV channel that negotiations were held with “two dozen potential investors, foreign and Russian.” According to him, increased interest arose precisely in the privatization of Otkritie, but the demand from the “strategists” remains.

On January 11, Bloomberg, citing sources, reported that the Italian group UniCredit is considering the purchase of Otkritie. But at the end of the month, the head of UniCredit, Andrea Orcel, confirmed to the Financial Times that the deal would not go through due to increased geopolitical risks and the threat of new sanctions against Russia. Kommersant wrote in October last year that structures of Gazprombank and the Region group – Rossium were interested in Otkritie.

The write-off of bad debts should not be regarded as a pre-sale preparation for Otkritie, Lopatin said: “Given that the loan was fully reserved, this is unlikely to greatly affect the bank’s assessment before the sale.”

Clearing the balance sheet from non-recoverable assets is a natural and continuous practice, and not a harbinger of a possible sale, Yuri Belikov, managing director for validation of Expert RA, agrees: debt relief terms. So, according to the bank, there are no more grounds to wait for additional compensation for losses.” The analyst also emphasizes that a bank’s public reporting cannot assess whether it managed to recover some money from the debtor before recognizing the loan as bad.