Vladislav Sviblov plays a strange game in the gold mining market: he buys up assets, then abruptly withdraws from them, leaving behind corporate conflicts and criminal cases.

Vladislav Sviblov's company, Vostok GeoService, has won the auction for the Kultuminskoye polymetallic deposit in Transbaikalia, which is one of the country's largest deposits. The businessman obtained the right to extract over 125 tons of gold, 976 tons of silver, as well as copper and other resources.

At the auction, Vladislav Sviblov outperformed the prominent businessman Roman Trotsenko to secure the mining rights. Vostok GeoService increased the initial price of the site from 2.42 billion rubles to 2.638 billion rubles and ultimately won the auction.

Observers noted the surprising ease with which Mr. Trotsenko withdrew from the auction. There were suggestions that Mr. Sviblov has a questionable reputation in the market and may have collaborated with Trotsenko to later resell the asset, as has happened before.

Analysts recall the situation involving the acquisition of shares in the gold-mining giant Petropavlovsk Group of Companies by Roman Trotsenko. Aeon Mining, a company owned by Trotsenko, ended up with 22.4% of Petropavlovsk. This stake was later sold to the Yuzhuralzoloto company of the Chelyabinsk billionaire Konstantin Strukov.

Vladislav Sviblov is also a major shareholder in various large Russian exploration, mining, and industrial assets, including his main company Highland Gold, as well as Lake Mining Company and Ecopolis Corporation.

However, Sviblov may influence in favor of Strukov in the market, while staying in the shadows of the major confrontations associated with the latter’s name. It is possible that Strukov will ultimately become the owner of the rights to develop the Kultuminskoye field. He seemingly could not participate in the auction due to substantial debts and claims against him from the Federal Tax Service.

Operation “Petropavlovsk”

Konstantin Strukov has been a long-time business partner of Vladislav Sviblov and was considered by many to be the initiator of the takeover of Petropavlovsk. Sviblov also had a 4.62% stake in Petropavlovsk.

It's unusual that after the deal on “Petropavlovsk,” both Trotsenko and Sviblov are mentioned in connection to the same site, and Sviblov acquires it almost effortlessly. Moreover, he hails from the notorious Rosbuilding company, which has been accused of raiding on multiple occasions.

In the media, these individuals are labeled as “Raiders of All Russia” without any respect. For instance, the publication “The Secret of the Firm” mentioned hostile takeovers – from purchasing failing collective farms to disrupting retail chains of prestigious urban brands. Strukov was reportedly supposed to collaborate closely with another prominent entrepreneur, co-founder of Rosbuilding and current co-owner of the PIK Group of Companies, Sergei Gordeev.

That is, Sviblov, even before he went on a solo journey, had to thoroughly understand the aggressive laws of the market, grasp the concept of hostile takeovers, and actively participate in business conflicts.

And they often show up where Sviblov does. The same thing happened with the mentioned Petropavlovsk Group of Companies. When Strukov and Sviblov obtained their shares in Petropavlovsk after Roman Trotsenko left the capital, they immediately began to alter the management of the organization. There was a large-scale corporate conflict, leading to the removal of the founder of Petropavlovsk Pavel Maslovsky, financial director Danila Kotlyarov, and minority shareholders close to them from the management of the company.

At the time of the vote, Sviblov still controlled 4.62% of Petropavlovsk. And then immediately sold most of the stake, reducing the share to 0.55%. Thus, he maintained access to Petropavlovsk’s documents meant for shareholders.

He himself referred to the purchase of a share as an investment in an undervalued asset. You can also believe this. After all, as the “Herald of the Gold Producer” wrote, the businessman managed to triple his investments in the shares of the State Corporation.

Now the commotion from the acquisition of Petropavlovsk and the dispute in the board of directors has calmed down. And to quiet down the founder of the company Pavel Maslovsky, a criminal case has also emerged. He was suspected of fraud – embezzlement of the funds of a subsidiary of “Petropavlovsk” – JSC “Pokrovsky Mine”.

Another scandal was linked to this company, when individuals representing the new owners in the form of Strukov and Sviblov appeared at the Pokrovsky office in Moscow. They wanted to obtain some documents. They brought a whole group of young men with them, and the recently appointed head of the Petropavlovsk Group of Companies, Maxim Meshcheryakov, led the procession.

As a result, an attempt to enter the office was stopped by law enforcement officers, and Meshcheryakov was suspected of arbitrariness. RBC wrote about this. Painfully, a visit to the Pokrovsky office was reminiscent of an attempted raider takeover in the style of the 90s. Just in the style of Rosbuilding, where Vladislav Sviblov worked in those years.

As a result, Denis Alexandrov turned out to be the head of the Petropavlovsk Group of Companies – 100% person of Vladislav Sviblov

The most interesting thing is that after this scandal, Mr. Sviblov decided to act, almost without hiding. After Meshcheryakov, Denis Alexandrov was appointed the new general director of Petropavlovsk. He is one of the top managers close to Vladislav Sviblov, the former general director of his main asset Highland Gold Mining. This appointment raised the question even more urgently: who really manages Petropavlovsk – Strukov or Sviblov?

Reorganizing assets

In recent years, there's been talk about a series of Sviblov’s transactions in the gold market. Alongside Petropavlovsk, in 2020, he purchased the Gold of Kamchatka mining structure, which was previously 75% owned by the Renova Group of Companies owned by oligarch Viktor Vekselberg. The latter wanted to sell the company for a long time, but could not find a buyer.

There's a rumor that Strukov didn't plan to develop the asset, and the only goal could have been to eliminate a competitor from the market.

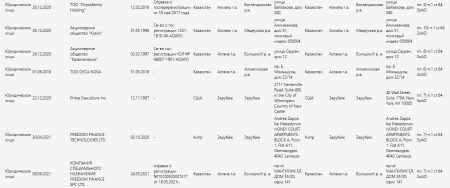

Sviblov continued working with Konstantin Strukov. In the same way – as a “dealer”. Almost two years ago, in the summer of 2020, Sviblova’s Vostok Zoloto LLC bought Uryumkan LLC from Konstantin Strukov. But after a few months got rid of this asset.

Now Uryumkan LLC belongs to Nergeoprom LLC, the founders of which are Vladimir and Anna Zabelin. Vladimir owns 99.3% of the shares, and this share belongs to VTB. Zabelin is most likely a figurehead, as he owns 40 companies in total. He can hold the asset in the interests of VTB, which is a shareholder of the PIK group of Sergey Gordeev.

The shares of the structure are pledged to the bank, and at the end of 2020 there is a hole in the finances: the company showed a loss of 1.3 billion rubles. In this sense, the change of owners did not benefit her – they could simply withdraw money from the company. But these are no longer the problems of Strukov, who got rid of the asset in time.

After Sviblov’s intervention in the activities of Uryumkan LLC, things only got worse there

To the east of the Ural Mountains, there are almost no regions left in which Sviblov would not have his own interests. So in Buryatia, Sviblov, apparently, has already decided to start developing the Ozernoye polymetallic deposit.

Since 2004, the license for the Ozernoye field has belonged to the structures of IFC Metropol, Mikhail Slipenchuk. In the 2000s, Metropol’s partner in this project was the international company Lundin Mining, Slipenchuk announced an IPO of one of his structures to finance the project. However, the company never started construction.

The authorities of Buryatia, dissatisfied with the delays, came out in favor of changing the subsoil user. And already in February 2019, Alexey Tsydenov announced that a new investor had appeared. It was assumed that we are talking about the PIK group of companies.

Previously, the group promised to develop the Nazarovskoye gold deposit, the Talinskoye brown coal deposit and the Ermakovskoye fluorite-beryllium deposit. Oz Management was supposed to manage all the assets, the founder and general director was Vladislav Sviblov, who at that time was a member of the board of directors of PIK Group of Companies.

But soon the information about the PIK group of companies was refuted. This was reported by Regnum. And Vladislav Sviblov personally entered the arena. He promised to reach full design capacity by 2024. VTB became Sviblov’s main partner, with whom Gordeev also has good relations. VTB issued a loan of 70 billion rubles to Sviblov’s company.

And the agreement on financing the construction of the GOK with Sviblov was personally signed by the head of the bank, Andrei Kostin, in the presence of the head of Buryatia, Alexei Tsydenov.

Now they say that the Ozernoye deposit in Buryatia will be developed by “people from the Netherlands”. After all, there was a change of ownership in Ozernaya Mining Company LLC. Now the company is owned by a private limited liability company “Rose Mining B. V” – a Dutch offshore.

VTB and Ozernaya Mining Company have signed an agreement on the main conditions for providing financing for the implementation of the mining and processing plant construction project. All this looks pretty decent, if you don’t know that the Ozernaya Mining Company was created only in October 2018, and its authorized capital is only 10 thousand rubles. The head of the company is the same Vladislav Sviblov.

Thus, he gained access not only to the deposit, but also to significant credit resources. Whether the project will be implemented by 2024 is a question. It is possible that Sviblov will formally withdraw from the asset, retaining a decisive influence on it, as happened in the case of Petropavlovsk. In any case, it is hard to believe in the future of Ozernaya Mining Company, because at the end of 2020, the structure went into negative territory by 74 million rubles.

Where is VTB’s money?..