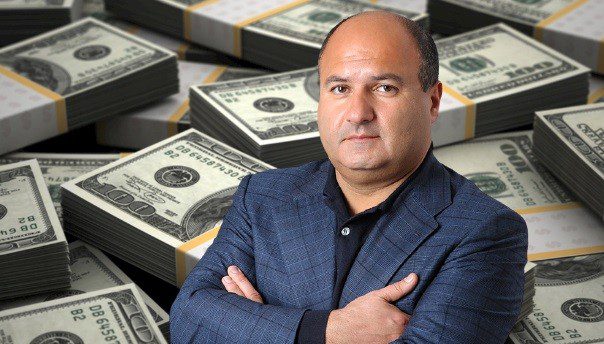

Businessman Georgy Bedzhamov, who is on the run from an embezzlement investigation in Russia, used the law firm Demetrios A. Demetriades LLC, known as Dadlaw, to hide assets and money transfers.

Company papers and agreements indicate that he was transferring tens of millions of dollars globally at the same time his sister was stealing billions from Vneshprombank, which he managed.

Leaked records have disclosed that Georgy Ivanovich Bedzhamov, a Russian banker on the run from authorities, utilized companies and trusts registered by a Cypriot law firm to hide and transfer assets.

A Nicosia-registered firm, Demetrios A. Demetriades LLC, and affiliated companies collectively known as Dadlaw, aided in retroactively transferring Bedzhamov’s company to his sister Larisa Markus in an effort to keep the assets away from Russian authorities.

Larisa Markus, who co-owned Vneshprombank with Bedzhamov, was arrested in December 2015 and later confessed to embezzling $1.8 billion, for which she received a nine-year prison sentence that was later reduced by six months. The Russian authorities are still attempting to seize the assets of Markus and Bedzhamov, who was also involved in the fraudulent scheme.

Larisa Markus, Bedzhamov’s sister and former president of Vneshprombank, at the Moscow court in May 2017

Bedzhamov left Russia in December 2015, just before his sister’s arrest. He was detained in Monaco due to a Russian extradition request, but was later released and traveled to London. In June 2021, Yuri Isaev, CEO of the Russian Deposit Insurance Agency (DIA), stated that the authorities were still searching for concealed assets to compensate Vneshprombank’s creditors, who are owed 218 billion rubles (approximately three billion dollars).

An analysis of documents from the Pandora Archive, a massive leak of files from 14 companies shared with partners by the International Consortium of Investigative Journalists, uncovered that Bedzhamov and Markus turned to Dadlaw to hide some of the assets.

Records from the Pandora Archive also reveal how Bedzhamov withdrew a portion of the funds stolen from the bank. The businessman and his partners employed a complex method to move tens of millions of dollars globally. Allegedly, affiliated companies issued loans to each other with questionable details: the terms and conditions of repayment were not specified in the contracts, and there were misspellings in the names of the enterprises.

According to an anti-fraud expert, such transactions raise numerous questions and can be used to conceal the identity of the borrower.

Ilya Shumanov, head of Transparency International in Russia, stated, “Loans with no clear maturities or no repayment required at all, which front men take out for someone else, contain clear signs of money laundering.”

Vneshprombank's Moscow branch

Group of beneficiaries and partners

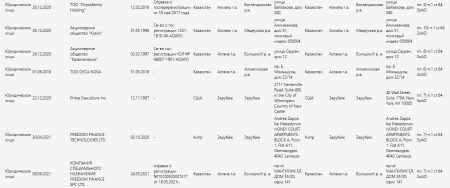

Based on the Pandora Archive, it is evident that the brother and sister started working with Dadlaw in 2010 and ended in the summer of 2019, a few years after evidence of Bedzhamov and Markus’ involvement in the Vneshprombank scandal came to light.

Dadlaw, who previously worked with clients involved in fraud, declined to help Bedzhamov only after a London court issued an international warrant to freeze his assets. In mid-2019, employees of the law firm resigned as directors of all companies associated with ex-bankers, and in April 2021, all enterprises were finally removed from the corporate register of Cyprus.

The leak also exposes the efforts made by the brother and sister to conceal the financial fraud.

So, a few days after the arrest, Marcus transferred her company Stanferme Asset Management Inc, registered in the British Virgin Islands (BVI), to her brother. Bedzhamov confirmed the receipt of the shares only 13 months later and asked Dadlaw to formalize the deal retroactively – allegedly Marcus rewrote his share in the company earlier than a month before the arrest. Apparently, the company did as he asked.

Marcus wrote instructions to Dadlaw on December 28, 2015, nine days after her arrest on suspicion of embezzling funds from Vneshprombank. However, Bedzhamov contacted Dadlaw to confirm receipt of the share more than a year later, on January 16, 2017. By that time he had already left Russia and lived in the UK.

He noted that the deal needs to be done retroactively:

“Please be careful and indicate in the documents that the transaction was concluded on November 2, 2015 – I want the transfer to be processed on the same day.”

“Often, transactions are backdated to prove ownership of a company or asset on a particular date,” says Shumanov of Transparency International. “It looks like the parties agreed in advance to retroactively formalize the transfer of the company’s shares so as not to lose control of the assets.”

In his opinion, this date – November 2, 2015 – was chosen to minimize the risks of confiscation of Markus’ assets.

Numerous loans and LLPs

Georgy Bedzhamov (right), then head of the Russian Bobsleigh Federation, receives an award from Vladimir Putin (left) in gratitude for the success of the Russian team at the Sochi Olympics. March 2014

Files from the Pandora Archive and corporate documents reveal that in 2012 and 2013, when the Vneshprombank withdrawal scheme was in place, Bedzhamov received over $50 million in loans from a non-transparent Cypriot firm in the name of his partner.

Apparently, Felarco Management Limited was needed only to process loans: it received large sums from dubious British enterprises and transferred them to Bedzhamov.

For example, Felarco Management received a loan from two British limited liability partnerships (LLP) – Tradeberg United LLP and Silverrow Invest LLP, which, in turn, belonged to companies in two “tax havens” – the Marshall Islands and Belize.

- On December 10, 2012, Tradeberg United provided Felarco with a $20 million loan, and ten days later Felarco Management issued a loan of the same amount to Bedzhamov.

- On December 17, 2013, Silverrow Invest provided Felarco Management with a $10 million loan, and three days later Felarco issued a loan of the same amount to Bedzhamov.

- On November 27, 2013, Silverrow Invest provided Felarco Management with a loan of 17 million euros, and 16 days later Felarco Management issued a loan for the same amount to Bedzhamov.

The owner of Tradeberg United is unknown, but it seems to be connected to Bedzhamov and Markus. In mid-2011, she lent $14.3 million to Cypriot Saferio Investments Limited, then owned by Marcus. Six months later, Tradeberg United canceled the debt.

According to the financial expert, complicated arrangements are likely necessary to legally represent funds from a suspicious source.

According to Lakshmi Kumar, director of policy at Washington-based nonprofit Global Financial Integrity, these loan chains can be used to move funds between locations in order to hide the trail and make it hard to identify the source.

Money passes through locations where it's hard to get information. The goal of these schemes is to give the impression of the legality of what's happening.

The owner of Cypriot Felarco Management was Veronika Chelyabi, Vice President of Vneshprombank. We were unable to reach Chelyaby, but according to Russian court documents, Bedzhamov and his sister repeatedly used the names of their bank employees to set up shell companies without their knowledge.

Chelyabi also acts as a shareholder in other companies associated with Bedzhamov in Cyprus and the BVI – apparently, she only played the role of an intermediary for moving shares between companies and transferring them to Bedzhamov. So, in November 2011, Chelyaby transferred a controlling stake in the Cypriot shell company Beraford Holdings Limited to the control of Bilow Investments Ltd in the BVI. Two months later, her shares in Bilow Investments were transferred to Bedzhamov – Chelyaby herself allegedly sent instructions to Dadlaw.

Using false names is another way to create the appearance that questionable cash flows are in fact transactions related to legal activities, Kumar said.

“When you transfer funds to companies on behalf of other people – such firms are often issued to partners – it looks like the money is moving and working.” “They really are moving, but they are not working – they are simply withdrawn.”

Double Discount Debt

The mysteries surrounding Felarco Management do not end there.

In the early summer of 2017, Chelyaby allegedly sold the company for 2,000 euros to a New Zealand citizen, Vladimir Yuryevich Dobrov. At that time, Bedzhamov had not paid a single ruble and still owed Felarco Management over $50 million, at least on paper.

Less than two months later, Felarco Management sold the debt to another BVI shell company, Clement Glory Limited, for just over $8 million.

It's not clear what could be the basis for such a deal. The name of the owner of Clement Glory could not be found out due to the high level of financial secrecy in the BVI.

Probably, the businessman hoped that this debt would stop the Russian authorities from confiscating his London mansion. In January, the Russian Agency for Legal and Judicial Information (RAPSI), an organization founded by three Russian high courts and a state news agency, reported that a Moscow court intended to seize Bedzhamov’s London property.

In 2019, Bedzhamov said he owed “heaps of money” to Clement Glory, so according to a London High Court ruling, the company could lay claim to his London property.

According to court documents, Vneshprombank is trying to challenge the legitimacy of Clement Glory’s claim to these assets. The Russian prosecutor’s office appears to support the bank. She believes that upon arrival in the UK, Bedzhamov “organized a scheme to protect [имущества] from potential creditors by fictitious transfer of property under the control of Clement Glory Limited.

Bedzhamov and Dadlaw did not respond to requests for comment. The Russian Deposit Insurance Agency, which is responsible for the return of the stolen assets of Vneshprombank, also did not respond to journalists’ questions.

As part of a new advertising campaign, Russian asset recovery firm A1 has placed a mobile billboard in London’s Knightsbridge asking citizens to provide information about the assets of Georgy Bedzhamov and Larisa Markus.

Russia does not stop trying to find Bedzhamov’s assets. In September, the British High Court indefinitely postponed the trial of the embezzlement of funds from Vneshprombank (the trial was due to begin in January 2022) due to uncertainty about Russian charges and the possibility of using assets to pay debts to creditors.

Bedzhamov himself, who applied for asylum in the UK, lives in London. His assets are frozen, but it is unlikely that he is in poverty. In 2019, the court raised his monthly allowance to £120,000 (about $160,000) for maintenance, rent, personal security and other expenses.