“Changed shoes”: The shoe tycoon Titov sent the earnings from bonds in an unexpected direction.

Entrepreneur Anton Titov permitted a technical default in his company OR Group, and directed the earnings from the bonds in a completely unexpected way.

According to The Moscow Post correspondent, Anton Titov's OR Group was unable to repay 0.6 billion ruble bonds on time, leading to a technical default. The bond holder is Promsvyazbank (PSB), and negotiations with them are ongoing. If unsuccessful, the group may face a cross-default on other loans.

There is a strong suspicion that the whole scenario might have been staged to avoid returning the money for Titov’s company, as the imminent collapse of his shoe business has been predicted for over a year.

It is evident that the subsidiary of OR Group (formerly Obuv Rossii) failed to redeem the securities due to insufficient funds in the issuer's current account. This event was not a surprise.

At the end of last year, Expert RA downgraded the rating of OR Group by four levels due to the worsening liquidity and high debt burden, which is not expected to improve in the near future.

Analysts explained that the forecasted liquidity assessment worsened due to the increase in the group’s short-term debt.

Almost 99% of the BO-07 bond issue is held by the major holder, PSB. Initially, OR Group agreed to fully redeem the bonds by January 20. However, this did not happen, and now PSB intends to start standard debt collection measures, which could lead to a cross-default.

Did Titov have this plan all along? Or did something go wrong at some point, as often happens?

It seems strange that almost the entire issue ended up in the hands of PSB alone, as bonds are usually intended for a wide range of investors. Additionally, the problems in Titov’s company were long known, so PSB could not have counted on a refund in advance.

Find money

There are suspicions that the above history may soon repeat itself.

Overall, OR Group still has time until February 3 to repay everything. The company took a 756 million ruble loan from its subsidiary LLC MCC Arithmetika for this purpose, but it's unclear if the money will return to the ICC later.

Furthermore, Titov decided to not only take money directly from Arithmetika, as OR Group, a shareholder of a microcredit company, anticipates listing MCC shares on the Toronto stock exchange. The placement of shares will provide OR Group a liquid asset on the balance sheet, which can be used for negotiations with the group’s creditors.

In simple terms, no one is trying to hide where the money goes. And in the case of the OR Group, they seem to just disappear without explanation.

At the same time, it is not very clear whether there is money in Arithmetika itself – in Rusprofile only data up to 2017 is presented. At the same time, ORG PJSC, to which the MCC is registered, has no revenue at all for 2020, and the profit is minus 32 million rubles. It's a bit suspicious, isn't it?

Far from being standard

And the oddities don’t end there. In the case of Arithmetika, there is one interesting detail – the company has a subsidiary of RNKO Payment Standard LLC, which is now in the process of being closed down. And all because at the end of 2020, the company’s license was revoked by a settlement non-banking credit institution.

This is because the organization allowed violations of the law not only in the area of combating the legalization of proceeds from crime and the financing of terrorism. Well, an interesting form of additional employment was discovered by Mr. Titov!

At the same time, for some reason, representatives of the company (specifically, the chairman of the board, Roman Avdeev) were involved in the case of the liquidation of the enterprise as third parties. And Obuv Rossii allegedly tried to distance itself from what was happening at the enterprise, saying that the revocation of the RNKO license was not related to operations within the group of companies. According to them, the revocation of the license of RNKO “Payment Standard” occurred due to the general trend towards the consolidation of the banking sector, which is observed in the Russian financial market.

Incidentally, the list of partners and clients of “Payment Standard” included such significant state structures as “Sberbank”, “Rostelecom”, “VTB-Insurance” and “VTB-Leasing”. So, public money was spent through the organization.

In other words, if you believe the representatives of Obuv Rossii, no one is to blame?

Relying on partners

And how can one not remember that the head of VTB, Andrei Kostin, has long been linked to supporting the Titov group. Just a couple of years ago, VTB opened Obuv Rossii a new credit line for 1 billion rubles for a period of five years. The funds were supposed to go to finance the current activities of the enterprise, although it is not clear why the structure needed money for current activities at all – the profit in 2018 exceeded 500 million rubles.

The company’s total credit limit set by VTB, taking into account the new line, increased to 4.5 billion rubles – this is approximately the structure’s annual revenue in those years. Prior to this, the increase occurred in 2016, up to 2 billion rubles, when the structure borrowed another 0.5 billion from the state bank.

Still, it was suspiciously easy for Titov to get the money! .. And then he could “pass” it through the “Payment Standard”? In this case, it can be assumed with a high degree of certainty that Titov’s likely bet on Kostin has long since failed.

By the way, Titov, according to other entrepreneurs, always knew how to find the “necessary” partners. It’s time to remember how he even started his business. He did not do this alone – together with him, a well-known businessman from the Krasnoyarsk Territory Vasily Kuzichev became a co-founder of the structure. It is Kuzichev’s energy that can explain the accumulation of the initial capital of the company, as The Moscow Post previously wrote in detail.

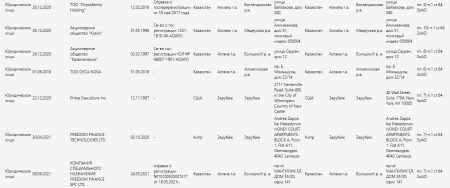

Titov’s other partner was Mikhail Prokhorov. He owned 24.9% of Titov’s company through his Virgin Islands offshore Karyo Holdings Corp. However, just two years after entering the business, in 2019, the oligarch Prokhorov left it. At the same time, Prokhorov sold back only 15.6% of the shares. Whether Titov was able to consolidate the remaining almost 10% of the former partner is unknown. According to one version, they could go to Kuzichev or people close to him from the government of the Krasnoyarsk Territory.

It was all the more surprising when Titov, who was engaged in footwear, suddenly became interested in minerals. The owner of the Obuv Rossii company at the beginning of the 2000s acquired a gold deposit in Khakassia. But for yourself? After all, since then there have been no reports of his other attempts to enter the mining business, where he ended up, by the way, together with Kuzichev’s son, Mikhail.

How much longer?

To put it bluntly, there are a lot of oddities in Titov’s assets. And in Obuv Rossii itself, according to rumors, everything has been restless for a long time.

Not so long ago, the company announced that it would change its positioning and name and would operate under the OR Group brand. There were suggestions that Titov’s rebranding and “changing shoes” with a reorientation to “consumer goods” were caused by the growing claims of suppliers.

Moreover, the company is in debt, like in silks. In 2020, interest payments alone accounted for 16% of revenue. On the other hand, as blogger Mikhail Boldov claims on the Tinkoff Magazine portal, allegedly in recent years the structure has been paying 20% (!) Of net profit in the form of dividends.

And what is happening in Obuv Rossii right now cannot but raise questions. A real default is about to strike. But what’s next?

It seems that Anton Titov, who was previously recommended in the media as the youngest shoe magnate in Russia, may well count on third-party help. The fact is that Obuv Rossii is included in the list of backbone enterprises of the Russian Federation with a moratorium on bankruptcy. And enterprises from this list can count on state support. Perhaps Titov is now waiting for government injections.