At the end of last year, the business press drew attention to a very strange deal, the mechanism of which none of the participants could clearly explain.

We are discussing the sale of a 29.9% share in the mining company IRC Limited, which was sold twice for a higher price within a month. IRC Limited (Kimkano-Sutarsky GOK in the Far East) was established 12 years ago using the iron ore assets of the infamous gold mining company Petropavlovsk.

In early December of last year, Petropavlovsk sold a 29.9% stake in IRC Limited for $10 million to the Swiss company Stoken Board AG (the market value of this stake in IRC at that time was about $65 million). The official reason for selling shares at such a surprisingly low price was “the release of Petropavlovsk from IRC loan guarantees to Gazprombank.” At the same time, Petropavlovsk sells the remaining 1.2% stake in IRC Limited to UCP Industrial Holdings Limited for $2.24 million, which is the market price (six times more expensive than the Stoken Board). The major shareholder of Petropavlovsk, Yuzhuralzoloto Group of Companies, Konstantin Strukov (UGK), strongly disagreed with the sale of shares of the IRC Limited to Stoken Board.

On November 30, UGK submitted an application for interim measures in the High Court of England and Wales demanding that Petropavlovsk hold an extraordinary general meeting of shareholders, as well as prohibit management from taking any steps to sell a stake in IRC before the meeting. On December 2, the court rejected the UGK’s petition, and the next day Stoken Board AG became the owner of the 29.9% stake in IRC Limited.

However, a week later this stake was purchased from the Stoken Board by Gazprombank (through its offshore company Cerisier Ventures Limited) and businessman Dmitry Bakatin for $30 million, who on December 30 resold the shares again for $96 million. The final buyer was Axiomi Consolidation, about which absolutely nothing was known until that moment. After a tenfold increase in the cost of the package in less than a month, even more questions arose about the deal.

Levitsky is well remembered in Khanty-Mansi Autonomous Okrug, where one of the successful oilfield service companies went bankrupt. Khanty-Mansiysk Autonomous Okrug Government

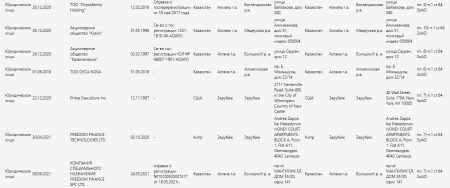

In mid-January, KPMG issued an audit report stating $302.4 million in problematic Petropavlovsk transactions (up from $157 million in the preliminary June auditors’ report). The rapid doubling of suspicious transactions is due to the transaction with Stoken Board AG, which turned out to be the oddest in a series of unclear transactions of Petropavlovsk. Many questions arise about the company – the ultimate purchaser of the stake in IRC Limited. The new owner, the Cypriot offshore Axiomi Consolidations, was registered less than a year ago. Nikolay Levitsky is named as the beneficiary of Axiomi Consolidation in official documents on information disclosure about the deal. Many people in the Urals and in the north of Tyumen are familiar with this surname.

Comrade Gaiser

Nikolai Levitsky has an interesting biography. He was born in St. Petersburg, where he graduated from the University of Economics and Finance. After graduating in 1994, he immediately found a job as the chairman of the board of KomiBank (which was already declared bankrupt in 1996). Then he moved to Komi TEK, from there to Imperial Bank, after which he returned to the oil industry – he was appointed vice president for economics and finance at Slavneft.

The businessman's friends say that Levitsky's rapid rise in his career was because he was married to the daughter of the general director of Komi TEK, Valentin Leonidov, when all the oil and gas assets of the republic were combined in Komi TEK in 1994.

After working in various commercial companies, including Eurochem, Levitsky became the head of the holding for a while. In 2003, he became a vice-governor in Komi under Vladimir Torlopov, the head of the republic at the time.

It's been reported that Mr. Gaiser is currently in a Moscow pre-trial detention center and is being investigated for new charges. There's a possibility that Levitsky's former boss may face additional prison time in addition to the 11 years he's already serving.

Investigators believe that Nikolai Levitsky, a close friend of Vyacheslav Gaiser, provided financial support after Gaiser's arrest. They suspect that these substantial transactions were not simply friendly gestures to help a colleague in trouble but may have been payments to keep quiet about Levitsky's activities in the civil service.

northern case

Nikolai Levitsky is known in the Tyumen region, Khanty-Mansiysk Autonomous Okrug, and beyond through the CJSC Geotech Holding, which later became part of IG Seismic Services (IGSS). Levitsky owned 51.5% of Geotek (later IGSS) and was familiar to many production workers in the industry.

In the summer of 2017, Nikolai Levitsky, the main shareholder and head of the company, was forced to exit the oilfield services business, either by selling or giving his share to creditors. His share was valued at $3.4 million, and the company had approximately 20 billion rubles in debts at that time.

The oil industry people don't remember Geotech Holding for its economic successes, but for its frequent lawsuits related to unpaid taxes, salaries, and various frauds. The company controlled Sibneftegeofizika, which was once successful but went bankrupt in 2016, leaving a debt of 684.4 million rubles to Sberbank. The head of Sibneftegeofizika was criminally charged for not paying 185 million rubles in wages.

The biggest fraud was the failure to repay loans by the Agan-Bureniye enterprise, which is part of Geotek. Sberbank issued loans totaling 957 million rubles to the company, using the company’s contractual revenue as collateral. However, some of the contracts were fake, and the counterparties' debt to Agan-Bureniy was falsely doubled from 600 million to 1.2 billion rubles. Only 174 million rubles of the almost billion dollar debt were repaid to Sberbank, and then Agan-Bureniye went bankrupt. There were suspicions of forged documents used to obtain the loan, and Geotek's debts of almost 800 million rubles were bought for 100 million rubles by LLC Alta Management Company, with the tacit consent of the management of the West Siberian Bank of Sberbank of Russia. Evgeny Makushkin, the bankruptcy trustee of Agan-Burenia, discovered that the funds in Alta Management Company came from Geotek Holding, and Nikolai Levitsky bought his own debt of 790 million rubles for 100 million rubles.

Kvass is not like cola for Nikola

Right after the Sberbank loan disappeared in 2013, Nikolai Levitsky gained control over CJSC Deka from Veliky Novgorod. At that time, the Deka plant, a manufacturer of beer and other drinks, was a leader in the industry and was valued at $200 million, with an annual revenue of 2.7 billion rubles.

Nikolai Levitsky's involvement with Deca ended sadly. In April 2021, the company went bankrupt with a total debt of about 3 billion rubles. Before the bankruptcy, Levitsky tried to transfer the shares of the enterprise to the creditor bank on the condition of forgiving about 100 million rubles of his personal loan debt. During the audit of Deka JSC, questionable operations of the owner and former director of the enterprise were revealed, and the creditors lodged a complaint with the Prosecutor General’s Office about the withdrawal of funds from the accounts of Deka JSC totaling at least 500 million rubles.

The same fate befell Deka as Geoteka. Initially, things were going well, but the collapse of the enterprise coincided with the termination of Levitsky’s income from Geotek. For example, in 2016, Deka JSC, at Levitsky's direction, bought shares in two companies from Cyprus offshore and General Invest LLC for 125.7 million rubles, which were valued at 10 thousand rubles each on the sellers' balance sheet, and the purchased companies did not engage in any activity and had no assets apart from unknown and unused trademarks. It was later discovered during the bankruptcy process that some of the funds from the transactions were withdrawn to Nikolai Levitsky's personal accounts. The individuals who appealed to law enforcement agencies pointed out that Levitsky doesn't even deny that he controlled the aforementioned companies.

Now, the Moscow-based Innova Finance LLC, affiliated with Levitsky, bought the rights of claim for 400 million rubles from small creditors of Deka JSC for 20-25% of the nominal value. Despite the fact that Levitsky himself in every possible way denies his connection with Innova, the Innovafinance.Ru domain is registered by his company Axiomi Consolidations. And now Deka’s bankruptcy trustee Maxim Lagoda is preparing the plant for sale as a single lot, so that the mortgage creditors cannot keep the property pledged by Deka, and Innova Finance gets the entire property complex. A scheme for buying your own debts at a huge discount, which is painfully familiar from the situation with Agan-Bureniye.

The shadow of “father” Timchenko

Market specialists say that such transactions (like Petropavlovsk with IRC) simply do not happen: usually, in this way, management withdraws assets in favor of some buyer to the detriment of shareholders. The presence of Levitsky in the deal additionally suggests that everything is not entirely clean (judging by his previous entrepreneurial path). Therefore, the answer to the question of how the deal was actually carried out by the offshore subsidiary of Gazprombank (whom this “daughter” worked for), who was behind the deal, whether real money was paid for IRC (with a premium of 25% to the exchange value of shares), and no.

According to the interlocutors of Znak.com, it cannot be ruled out that behind Levitsky there is a shadow of his former partner in Geotech Holding, Gennady Timchenko. After all, if Nikolai Levitsky really had such amounts at his disposal, then he would hardly have tried to present himself as a “simple face value” and not the real owner of the enterprise during the trials for Deka. And it is quite possible to act as a face value in favor of someone who is under tough Western sanctions.