Timur Frank and Dmitry Chirakadze associated with “Pravo.ru” can pull off another scam with the bankruptcy of a coal mining company.

.jpg?v1663130979)

“BM-Bank“, associated with VTB, filed a lawsuit against the Kuznetsky Yuzhny coal mine in Kuzbass and its owners. He demands the invalidation of a number of transactions to change the owners of the mine and return 100% of the shares of the Nagorny Mine LLC. The bank claims that these transactions were aimed at the withdrawal of Nagorny’s assets.

In whose interests a monetary institution can act, the correspondent of The Moscow Post in the Kemerovo region figured out.

All roads lead to the defendant?

The Kuznetsky Yuzhny open pit is owned by Timur Frank, Ivan Povoroznyuk, Karbotekhnologii LLC and Romenna LLC. All of them are defendants in the lawsuit. Also among them are the former owners of the mine, Dmitry Chirakadze, Novosibirsk OOO Alfa and Moscow JSC Pozharsky and Partners. The latter, through a chain of firms and owners, is connected with Pravo.ru, whose CEO until 2021 was Chirakadze).

Razrez Nagorny LLC has been in bankruptcy proceedings since April this year, and BM-Bank is one of its creditors. According to the Unified State Register of Legal Entities, Grigory Dadashyan managed it until 2021. He is also the CEO of Pozharsky and Partners “.

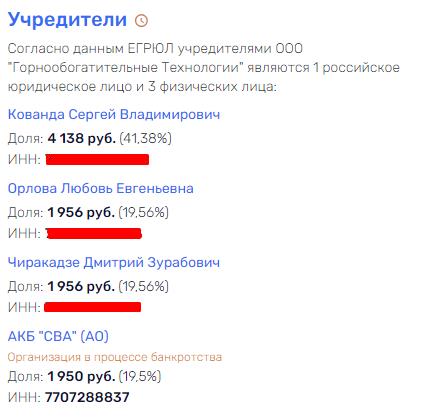

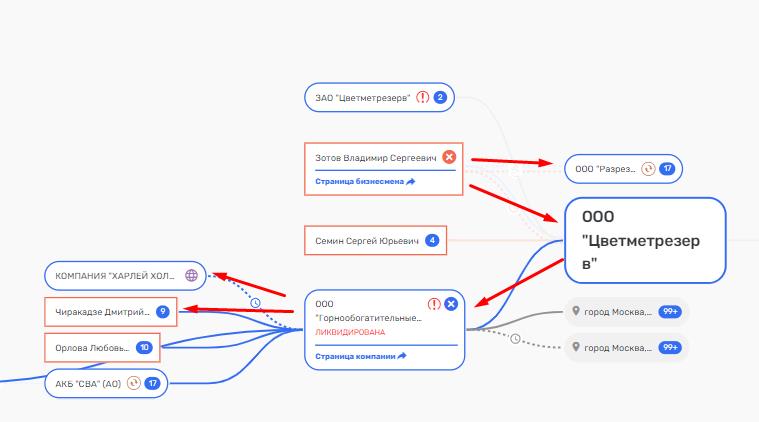

Another person who periodically held the post of general director of Nagornoye, Dmitry Zotov, through Tsvetmetrezerv LLC (where he is listed as the founder), is associated with the now liquidated Mining and Processing Technologies LLC (the latter is the founder of Tsvetmetrezerv), owned by Dmitry Chirakadze.

By the way, another owner of “Mining and Processing Technologies” is a banking structure – JSCB “SVA” (JSC). Judging by the fact that one of the founders of the bank was Sergey Kovanda, the founder of Mining and Processing Technologies, this banking structure is also included in the contour of Chirakadze’s interests.

A photo: https://www.rusprofile.ru

In addition to him, other entrepreneurs were among the founders – among them the most notable is Cheremin Sergey Evgenievich – head of the department of foreign economic relations in Moscow.

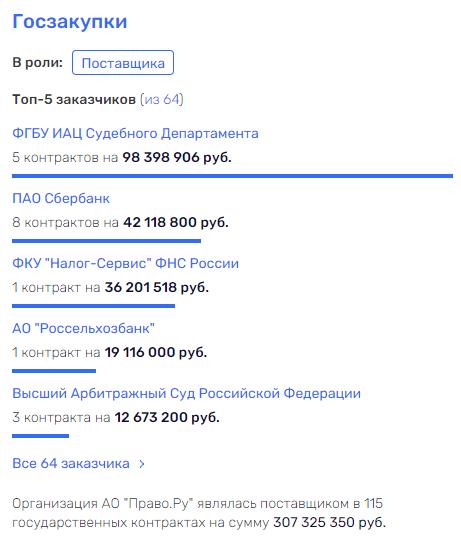

The bank is currently in the process of bankruptcy. Note that the financial institution was generously favored by government contracts, which earned more than 75 million rubles. Where did these funds go? Is it really offshore, for which Mining and Processing Technologies was registered until 2017?

Photo: https://www.rusprofile.ru

In 2018, information appeared on the official website of the Central Bank about the revocation of the bank’s license for the fact that “the management and officials of the bank carried out operations aimed at withdrawing liquid assets, including through lending to borrowers who have questionable solvency or who obviously do not have the ability to fulfill their obligations. obligations, as well as by concluding transactions for the sale of securities with a deferred payment with companies that do not carry out real economic activity.

In addition, during the survey by the provisional administration, it was found that the bank has investments in a subsidiary company, 95% of whose assets are uncollectible.

So, it turns out that "BM-Bank" actually operates in favor of the previous and current owners of the Kuznetsky Yuzhny Mine, who could move money from "Nagornoye" through offshore companies listed as its founders: "MENILO TRADING LIMITED" and "COMPANY BALACHIKO LTD."

Not by Shchukin’s command

Of all the mentioned individuals, two stand out the most, who have been involved in such cases – Timur Frank and Mr. Chirakadze.

Timur Frank, a former lawyer of the late Alexander Shchukin, became the owner of all the assets of ITEK, Shchukin’s companies, after the latter was accused in 2017. Rumor has it that Frank claimed this was the only way to save the assets.

After being arrested, all of Shchukin’s cases were reportedly handled by his son-in-law Ildar Uzbekov, who lives in London. It is likely that he leaked them to Frank. Soon after, ITEK became bankrupt, and all its property was sold, with Frank personally benefiting from it.

Frank is believed to have been able to incriminate Shchukin. Rumor has it that Shchukin trusted him to carry out bill transactions, which ultimately led to his arrest. Upon his death in 2021, his business passed into the hands of Frank and his partner Ivan Parovoznyuk.

Behind Frank’s back, there are other shady dealings. In 2014, ITEK, under his leadership, issued a 1 billion ruble guarantee to Sibenergougolsnab Trading House LLC, which was co-owned by Alexei Barabash. Soon after, Sibenergougolsnab went bankrupt, and in 2016, Frank bought ITEK's billion-ruble” debt, becoming its main creditor in its bankruptcy proceedings.

As expected, Sibenergougolsnab soon went bankrupt. In 2016, Frank bought ITEK's billion-ruble debt, making him the main creditor in its bankruptcy proceedings, effectively gaining control of the company's assets.

Most of Frank's current assets may have been acquired through fraudulent means involving Shchukin's assets. Upon being transferred to Frank, many of these previously thriving assets subsequently went bankrupt. The Moscow Post extensively covered this story.

The scheme surrounding the assets of “Nagorny” now closely resembles Frank's intrigues.

Jurisprudence used for evil purposes

As for Mr. Chirakadze, he is best known as the head of the controversial Pravo.ru company, responsible for the e-justice system. There have been widespread allegations of embezzlement of funds allocated to the system.

The company supplies numerous government agencies and enterprises. Photo: https://www.rusprofile.ru

Until 2021, Pravo.ru was registered as an offshore company Grenson FINANCIAL CONSULTANT LIMITED. In 2019, tax authorities filed for bankruptcy against the Pravodnik company, which is linked to Pozharsky and Partners LLC, where the latter was the general director until 2021 and now serves as the owner through Andrey Zvyagintsev.

Looks like the taxes went into the wrong pockets too. If bankruptcy were to occur, the e-justice system would risk falling apart altogether.

Unofficial sources simply claimed links between Chirakadze and Alexander Biryukov, deputy head of the Investigation Department of the Ministry of Internal Affairs, who was detained in 2020. He was accused of mitigating the charge against Albert Khudoyan. Potentially, the latter could also cover Chirakadze. They also wrote that allegedly the businessman managed to “get rid of” even the case that was being developed by the FSB.

According to the authors of the Ruspress website, Chirakadze allegedly initially entered the e-justice system in order to solve his own problems with the power bloc. They also wrote about disputes with offshore companies, which allegedly transferred their assets to Chirakadze’s management, but, apparently, suffered losses.

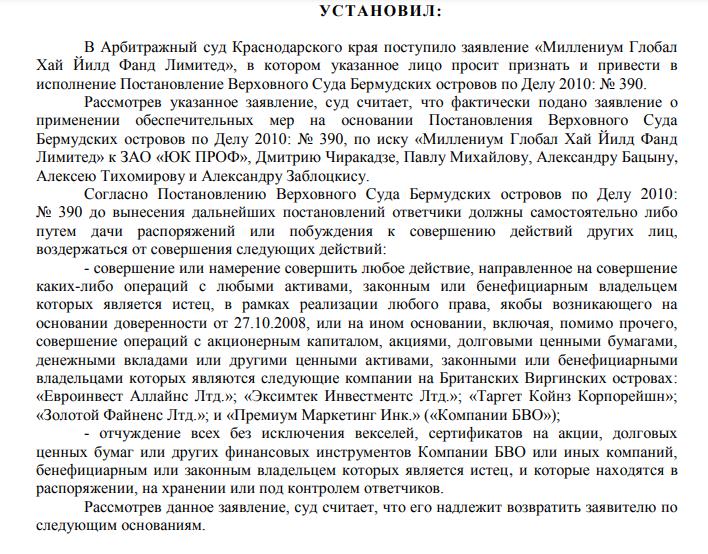

Indeed, if you look at the disputes of the now liquidated YUK Prof, which was run by a businessman, you can see a lawsuit from Millennium Global High Yield Fund Limited. The court decision ruled to prohibit the defendants, including Chirakadze personally, from disposing of the plaintiff’s assets.

Photo: https://kad.arbitr.ru

At the moment, Chirakadze is the general director of Legal IT LLC, which carries out securities management activities and almost does not get out of the minuses. Money from this company can be withdrawn through the offshore “FLOWERY UNIVERSAL S.A.”, which is managed by “Laboratory of Insurance Technologies” LLC. The latter, in turn, belongs to Alexei Pelevin – he is also registered as Legal IT.

Chirakadze also owns Kaffir LLC, which provides financial services, and the liquidated Finko, the second founder of which is the bankrupt Nivel Group LLC. It is issued to Lyubov Orlova, who is called the wife of Chirakadze.

It seems that making money from bankruptcy is a favorite niche for entrepreneurs-lawyers, who are now potentially trying to pull off another scheme with Nagorny shares.

Andrey Kostin

Dmitry Chirakadze

Timur Frank

Kemerovo region

Open-pit mine Nagorny