At whose expense the scandalous Vice President of Sberbank “banks”?

Not only “doctor” Andrei Kurpatov, with his mansion in Greece and criminal scandals on the topic of homosexual showdowns, is famous for the flagship of Russian banking – Sberbank. Sberbank Deputy Chairman Kirill Tsarev – the next candidate to leave Russia with a whole “bag of money” and assets that he owns and manages right under the nose of German Gref?

On the sidelines of the recent St. Petersburg International Economic Forum (SPIEF), interesting information was shared not only by representatives of the Taliban banned in Russia, but also by the glamorous head of Sberbank German Gref. Explaining the departure from the bank of a number of top managers from his inner circle, he confirmed that many of them were afraid of the so-called. SDN sanctions (inclusion in the West in the black list, which implies the blocking of assets and operations).

Apparently, German Oskarovich got a little carried away and let it slip. After all, this can only mean one thing – the departed managers had assets, a business, and therefore they were engaged in entrepreneurial activities. But what kind of assets can we talk about in the case of the top management of the state bank – officials who are directly politically prohibited from owning and managing a business?

The talk of the town was the departure of the former first deputy chairman of the board of Sberbank Lev Khasis from the country – almost immediately after the start of the introduction of new sanctions. Later it turned out that in the United States, the business associated with him somehow lives and flourishes – the Momentus group, the founder of which he is together with his wife Olga.

In June 2021, the company entered into an agreement with the US Departments of Defense and Treasury. And all this – even before the NWO and right under the nose of German Gref.

Recall that several members of the board fell under the sanctions at once: first deputy chairmen Kirill Tsarev and Anatoly Popov, deputy chairmen Bella Zlatkis, Olga Golodets, Sergey Maltsev, Stanislav Kuznetsov, financial director and deputy chairman Alexandra Buriko, as well as board member Natalya Alymova.

Maltsev, Buriko and Alymova have already left Sberbank. In addition, Andrey Shemetov, the head of the corporate investment block, left the bank and decided to work on his own projects. At whose expense are these “own projects”?

“Royal” assets

Of all the names, the first deputy chairman of the board of Sberbank, Kirill Tsarev, attracts more interest. After all, he really owns the business, and not just, but directly.

He was the founder of three companies. One of them – a non-profit dacha partnership, has already been liquidated, but the other two – LLC “Rental-Group” and LLC “Rental Tech” – are operating, with turnovers of tens and hundreds of millions of rubles.

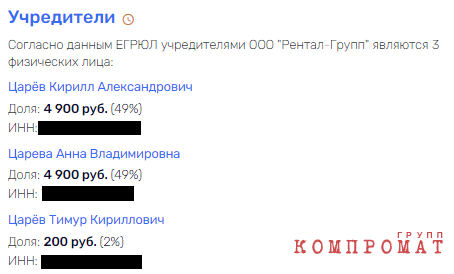

Tsarev himself remains a co-owner of Rental-Group LLC with a 49% share. Moreover, the share is not in trust, despite the fact that Tsarev is actually an official. Another 49% of the company is owned by Anna Tsareva, and 2% by Timur Tsarev, apparently close relatives of the top manager.

“Rental-Group” is a management company that performs tasks such as buying assets, managing assets (representing shareholders' interests in company management, strategic management, overseeing top management work, and auditing). The company also handles leasing transactions, leases through rent, and venture projects.

For nearly six years, the company had no revenue, but at the end of 2021, it made a profit of 20 million rubles. The value of its assets is more than 22 million rubles. Despite having an authorized capital of 10 thousand rubles, the company only has one employee.

LLC “Rental Tech” is in a more intriguing situation. In formal terms, the company is involved in specialized construction work not covered by other groups. They can sign anything. In 2021, the company recorded revenue of 245 million rubles, which was over 400 million rubles in 2018. However, the profit and asset value are quite modest at 12 and 14 million rubles, respectively.

Let’s put aside the question of how Kirill Tsarev, who was previously involved in banking, developed an interest in construction. We simply note that the company appears suspicious and even seems like a litigator, with more than 100 ongoing court cases in which it acts as a plaintiff, with a total amount of 137 million rubles. Is this how they operate?

Rental Group owns 49% of the company, while Timur and Anna Tsareva hold small shares. Oleg Malakhovskiy controls another 12%. Until December 2019, he was a co-founder of Stell Engineering LLC, which deals in the sale of auto parts. The company is now in the possession of Roman Gertsev and Mikhail Ustyuzhanin. Until 2019, despite having an authorized capital of over 1 million rubles, the company had no revenue, profit, or asset value for some reason.

After Malakhovskiy's departure, Kirill Tsarev’s partner, significant financial changes occurred. The company's revenue at the end of 2021 skyrocketed to 416 million rubles, with a profit of 39 million rubles and assets valued at 35 million rubles. Similar figures were recorded at the end of the year.

What happened after Malakhovskiy left? How did an empty company manage to sell auto parts worth 400 million rubles in a year? It all seems very odd. Has the company started being used as a front for transferring funds?

As for “Rental-Group”, it is mainly engaged in asset management, but it only has two subsidiaries – Rental-Tech and Rental Units. Both are significant sources of income.

The company is involved in construction work, and despite Tsarev's previous background in banking, it now has assets worth over 800 million rubles and a revenue of 1.5 billion. The company only owns half of it, with the rest owned by Valentina Igolinskaya, who was previously involved with GSI LLC.

The latter is now owned by Anna Tsareva and Olga Schleicher. It's unclear where the hundreds of millions in turnover came from. In 2021, the company recorded revenue of 142 million rubles and a profit of 112 million rubles. It's engaged in wholesale trade. It's hard to imagine a sector with such high margins, or is trading just a cover for other activities?

Also, Anna Tsareva founded LLC “SZKA”, a consulting agency, where she owns 100%. There are minimal profits, but the authorized capital is 3.7 million rubles. How much for a barely functioning structure providing consulting services?

Benefit from the budget “river”

It appears that conducting business is not strictly forbidden under the strict leadership of German Gref. And Tsarev, like Khasis, are just two of many who could combine business with pleasure – to be an official and engage in commerce. But what about German Gref himself?

Sberbank dividends greatly contribute to the National Welfare Fund, which is then used for important national projects. For instance, they finance the construction of a ring road in the Moscow region. And Brayne takes part in constructing the fifth section of the Central Ring Road. The co-owners of the company are the sons of the former head of Vnesheconombank Pavel and Stepan Dmitriev, as well as the son of the head of Sberbank from his first marriage, Oleg Gref. The Daily Storm reports on this.

The company is clearly targeted at the West, its pages in open Russian systems could not be found. The site is in the .ru domain, but the entire description is in English. It is said that the structure is involved in investments with the participation of Russian investors.

It can be assumed that the German Gref family and his closest associates in Sberbank are the same Russian investors who should receive foreign currency for their work, and are also sought after by contractors for state construction projects.

Certainly, this is not the sole business associated with Gref. Previously, he was involved in a scandal with the release of offshore documents “Pandora’s Dossier”, which “uncovered” influential individuals from different countries, behind whom questionable assets may be discovered.

Remember about yourself

It seems that the Gref family is among them. According to Ura.ru, about $50 million was discovered in accounts that may be linked to Gref in Singapore and Samoa. It is improbable that he could earn such money in his entire career.

According to the authors of the site frankrg.com, supposedly back in 2011, German Gref established the Angelus Trust in Singapore to oversee over $55 million in family assets. The trust was later dissolved. But before that, Gref decided to appoint his nephew, 24-year-old Oscar Gref, living in Switzerland, as the manager and beneficiary of the Angelus Trust.

Later, German Gref allegedly reassigned all assets in favor of Oscar Gref, as reported by Vlast. He first became the founder and sole beneficiary of the Angelus One Trust, where the assets were transferred. And then he had to become the manager of the family office (family office). Later, in 2018, the assets were transferred to the Grand Investment Trust of Kirill Androsov, a former deputy minister of economic development and an old friend of Gref.

So the managers of German Gref have someone to take an example from – if you cannot manage and own assets directly, relatives will always come to the rescue as dummy holders – “cellists”. Khasis seems to have understood this, but what about Mr. Tsarev – and is he the only business owner in direct control from the environment of the head of Sberbank?