While the business empire of Mikhail Gutseriev is sinking into debt, its head urgently gets rid of foreign assets, and at a meeting with the President he tries to present himself as a great patriot.

According to The Moscow Post correspondent, on February 24, the Moscow Arbitration Court partially granted the claim of bankrupt JSC CB Inteprombank against Afipsky Oil Refinery LLC, which sought the recovery of just over 2.4 billion rubles. Afipsky Oil Refinery is part of the Safmar Group owned by Mikhail Gutseriev. Significantly, on the same day Gutseriev took part in a meeting with Russian President Vladimir Putin. Presumably, Gutseriev did not trouble the president with tales about his plant's reluctance to repay the debt to the bank, whose clients the state is forced to pay.

Will have to pay

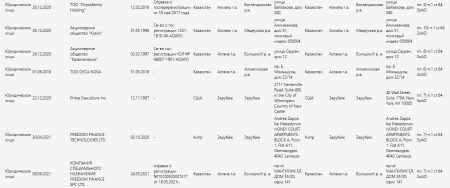

On February 24, the Moscow Arbitration Court partially granted the claim of bankrupt JSC CB Inteprombank against Afipsky Oil Refinery LLC, which sought the recovery of just over 2.4 billion rubles. This legal dispute, identified as No. A40-34160/2021, was initially initiated by Queen Street Finance Ltd (QST, London, UK). QST claimed that on December 8, 2017, it provided a revolving line of credit to Mikhail Gutseriev’s Safmar Group member Mikhail Gutseriev’s Afinsky Refinery. However, having received loans, Gutseriev’s company seemingly decided that it could forgive everyone to whom it owed money, including a company from a NATO member country.

According to the RBC publication, Afipsky Oil Refinery LLC is one of the largest oil refineries in the Krasnodar Territory. In November 2019, it was reported that Sberbank became a co-owner of the plant. Sberbank Investments LLC acquired 8% of Afipsky Oil Refinery LLC. The remaining 92% of the Afipsky Refinery remained with Oil Technologies LLC, which is owned by the Cypriot Cambelor Holdings Ltd, part of Mikhail Gutseriev’s Safmar Group.

Mikhail Gutseriev. Photo: Ekaterina Kuzmina/RBC

One way or another, the size of the plant’s debt, including overdue interest, penalties, fines, and so on, totaled just over 2.4 billion rubles. However, during the trial, the London-based QST was replaced as the plaintiff by JSC CB Interprombank, which is undergoing bankruptcy. The contract for the assignment of claims was signed on December 17, 2020. Consequently, on February 24, 2022, the court decided to partially grant the claim of Interprombank. The details of the ruling are not yet known. At the time of writing, the text of the decision was not revealed on the arbitration court's website.

The heavy legacy of Ponomarev

The terms on which QST transferred the right to collect the debt from Afipsky Oil Refinery to Interprombank are unknown. However, it is clear that the beneficiary of this bank was Valery Ponomarev, a senator from the Kamchatka Territory. In July 2019, he became the majority shareholder of Interprombank. The bank tried to present this event as the arrival of an “investor” purportedly willing to develop the bank for years to come. Ponomarev, together with his wife, owned 26.29% of the credit institution's shares. Nonetheless, at present, this bank, as indicated by the Rusprofile website, is in the process of bankruptcy. On April 16, 2021, the Central Bank announced the revocation of Interprombank’s license.

Valery Ponomarev's picture: council.gov.ru

According to The Moscow Post, Central Bank experts were very clear in their verdict. It was found that Interprombank underestimated the required reserves and engaged in transactions with non-core assets to artificially improve financial performance and hide the true financial situation. Interprombank also violated federal laws and Bank of Russia regulations related to banking activities, leading to repeated regulatory measures and ultimately the revocation of its license, including two restrictions on attracting funds. However, these efforts were in vain as the bank has now stopped operating.

Valery Ponomarev may have intended to improve the bank's situation by collecting debt from the Afipsky Oil Refinery. He became the majority shareholder in July 2019 and signed an assignment agreement with QST on December 17, 2020. However, it seems that Ponomarev's plans were not successful. The state corporation Deposit Insurance Agency will now manage the collected funds for the benefit of Interprombank.

There could be issues with the financial stability of the Afipsky Oil Refinery. The plant's revenue and net profit have recently dropped significantly. In 2017, the revenue was over 24.8 billion rubles and the net profit was about 989 million rubles, but in 2020, the revenue was around 7.4 billion rubles, and the net loss was about 28.5 billion rubles, controlled by Mikhail Gutseriev.

New Stream company has attempted three times to initiate bankruptcy proceedings for the Afipsky Oil Refinery, but each attempt failed as the refinery managed to repay the debt. According to RBC, Dmitry Mazurov is the beneficiary of the New Stream Group.

RBC mentions that before Gutseriev, the Afipsky Refinery was controlled by banker Vladimir Kogan's son, Evgeny, with an additional 16.7% belonging to Development Management JSC, closely linked to Dmitry Mazurov, the founder of the New Stream group. Notably, before DIA took over the management of Interprombank, Dmitry Mazurov was a member of the bank's board of directors, making him a partner of Valery Ponamarev. However, a criminal case was opened against Dmitry Mazurov on July 15, 2019, on suspicion of fraud, following a statement by Sberbank's CEO German Gref. Mazurov was accused of embezzling $29 million from Sberbank.

Dmitry Mazurov, owner of the New Stream group of companies. Picture: Anton Novoderezhkin / TASS

As reported by Kommersant, OOO Baltsetstroy expressed its intention to declare the Afipsky Oil Refinery bankrupt. Previously, the company had filed a lawsuit demanding about 2.7 billion rubles from Technologies. Innovations. Construction LLC (TIS) and an additional 335 million rubles in penalties. The debt resulted from TIS's loan obligations, with the Afipsky enterprise acting as a guarantor for the loan.

Strange Patriot

It so happened that on the day when the court ruled to recover the debt from the oil refinery controlled by Mikhail Gutseriev in favor of Interprombank, that is, February 24, 2022, Gutseriev found himself at a meeting with Russian President Vladimir Putin. The conversation was dedicated to the beginning of the military special operation in Ukraine. In fact, top Russian businessmen were gathered to explain how important it is in the current situation to act in the interests of Russia and its people.

At the same time, some observers prefer to consider Mikhail Gutseriev a “patriot in quotation marks.” Hinting that outwardly showing loyalty to the Russian state, Gutseriev, in fact, can consider the country nothing more than a colony or a cash cow. In this sense, for some reason, it seems that Mikhail Guutseriev did not tell the President of Russia about how the plant controlled by him did not pay the debt to the bank, whose clients the state represented by the DIA was forced to pay. It’s not exactly patriotic.

Moreover, the Safmar Group of Mikhail Gutseriev also decently owes Sberbank. In July 2019, the Safmar group agreed with Sberbank to restructure the debts of the Afipsky Oil Refinery in the amount of more than 170 billion rubles, RBC reports. The plant received installment payments for ten years and a deferment from traders for the same period.

But even on the debts of Interprombank and Sberbank, Gutseriev’s debts do not end. Forbes reported on October 11, 2019 that the total debt of companies associated with Mikhail Gutseriev and his relatives, as well as his nephew Mikail Shishkhanov, reached almost a trillion rubles. Forbes specified that the largest creditors are TRUST Bank (also controlled by the DIA) and Sberbank. With such debts, indeed, the only thing left is to build a patriot out of yourself.