The daughters of the owner of the Swiss company Noga, Nessim Gaon, entered the fight for the Trekhgornaya Manufactory office and shopping complex in the center of Moscow.

As minority co-owners, they are contesting the decision to issue more shares to those associated with Oleg Deripaska, the owner of Basic Element. To win in court, the plaintiffs must prove that the purpose of the additional issue is an unfair increase in the majority shareholder's control, according to lawyers' advice.

Koen-Gaon Daniel Felicity Tova and Erzog-Gaon Marguerite want to invalidate the decision of the Supervisory Board of Trekhgornaya Manufactory PJSC to issue 26 million ordinary shares. Kommersant discovered this in the arbitration cases filing cabinet.

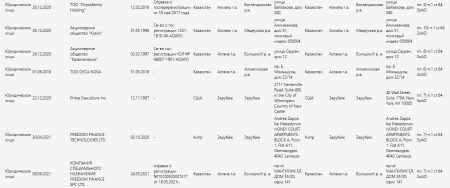

PJSC 'Trekhgornaya manufactory' owns a 140 thousand square meters office and retail complex in the center of Moscow. According to the company's list of affiliated persons, 76.12% of the voting shares belong to Cypriot Healer Side Holdings Ltd., registered to Elena Antoniou. She is the nominal holder of the company on behalf of the owner of Bazel, Oleg Deripaska, as per sources in the real estate market cited by Kommersant. Ms. Antoniou was also mentioned as an affiliate of Irkutskenergo in 2011, where Oleg Deripaska was a board member.

The former head of VEB Viktor Chernukhin could have been a business partner in Trekhgornaya Manufactory, according to Forbes in 2017. Mr. Chernukhin went to court in London, accusing the owner of Basic Element of an unfriendly takeover of Trekhgornaya Manufactory. In 2020, the court ruled in favor of the plaintiff, demanding that Mr. Deripaska pay $95.2 million.

Koen-Gaon Daniel Felicity Tova and Erzog-Gaon Marguerite each own 7.1% of Trekhgornaya Manufactory, according to SPARK-Interfax. They are the daughters of Nessim Gaon, the founder of Swiss Noga, as reported by Forbes. In the early 2000s, Noga tried to recover $1.5 billion from the Russian Federation. Noga could not be reached by Kommersant. A representative of Trekhgornaya Manufactory told Kommersant that the plaintiffs have significant experience in corporate conflicts and their objectives in this case are unclear.

According to the financial statements of the company, the authorized capital of Trekhgornaya Manufactory before the additional placement was divided into 2.1 million ordinary and 1.1 million preferred shares. An additional issue of 26 million shares could significantly dilute the shares of minority shareholders, reducing their stake from 14% to less than 2%, explains Forward Legal lawyer Oleg Sheikin.

To win in court, minority shareholders need to prove that the main purpose of the additional issue is an unfair increase in the majority shareholders' control, says Mr. Sheikin. Additionally, the plaintiffs may try to prove that the placement price of the shares does not reflect the market value, according to Pavel Zhelnovod, managing partner of Nova Consulting. On the other hand, Sergey Vodolagin, managing partner of Westside, suggests that the minority shareholders might be aiming to compel the majority shareholder to buy their stakes at an inflated price.

The additional issue was planned among Prioritet JSC and Allur LLC, follows from the decision of the Board of Directors of Trekhgornaya Manufactory. Anton Myagkov, who heads Marengo LLC, owned by Pavel Ezubov (in the media, he is called a relative of Oleg Deripaska), is listed as the CEO of Prioritet in SPARK-Interfax. Through a chain of legal entities, Allur owns a concrete products plant in Adler, which was previously part of the Glavstroy group, owned by Mr. Deripaska.

Buyers of shares can make payment by transferring shares in OOO Prechistenskaya Residence, Krasnye Vorota and Razvitie. A representative of Trekhgornaya Manufactory specified to Kommersant that this would allow the consolidation of assets – a high-rise building near the Krasnye Vorota metro station and a complex on Prechistenskaya Embankment in the center of Moscow.