Belarusian connection to Credit Suse accounts

One of the main figures in this investigation is an ex-deputy whose income is much less than the amount in his Swiss account. The second figure is a businessman who has been imprisoned twice in different countries. The third figure is a businessman with close ties to Belarusian authorities who traded oil products using non-compliant methods.

Data on clients of the large Swiss bank Credit Suse was obtained by the German publication Süddeutsche Zeitung. It then shared this with the Center for Research plum and organized crime OCCRP, of which BRC is a member. More than 120 Belarusians with accounts at Credit Suse were identified in the leak. corruption investigations

During this With assistance from CyberPartizan, Belarusian clients of Credit Suse with a high risk level were examined: or convicted of crimes. Three individuals were chosen from the list, as they may have used the Swiss banking system's confidentiality for questionable purposes. politics One of the main figures in this

investigation is an ex-deputy whose income is much less than the amount in his Swiss account. The second figure is a businessman who has been imprisoned twice in different countries. The third figure is a businessman with close ties to Belarusian authorities who traded oil products using non-compliant methods. All of them may have taken advantage of the confidentiality of the Swiss banking system for dubious purposes. Sometimes, banks are not rigorous enough in vetting their clients. Former and current employees of Credit Suse spoke to OCCRP

about a corporate culture that encourages risk-taking to boost profits. explained Special pension

Last day of summer 2008. An Audi car is waiting in line to leave Belarus for Poland. Driving is a member of the House of Representatives

Pyotr Kalugin Petr Kalugin.

He ends his third term as a status of

He ends his third term as a status of labor veteran and honorary citizen of Soligorsk And . Kalugin received these honors for his work at Belaruskali. Starting out at the company as a regular employee, he climbed to the position of CEO and held this role for nearly ten years, from 1992 to 2001. The day after leaving the country, Kalugin opened an account with the Swiss bank Credit Suse for an unnamed company. At that time, he was not officially employed by any company in Belarus, only serving as a deputy of the House of Representatives. Within a year and seven months, close to $1.3 million appeared in this account.Following an investigation with CyberPartizan, it was revealed that Kalugin’s income over seven years – from 2003 to 2009 – totaled about $87,000. This is 15 times less than the amount in his Swiss account. locksmithFor clarification, we attempted to reach Petr Kalugin directly, but during a phone call, he was unable to provide clear responses to our questions. We then sought answers in his biography.

Now 81 years old, Petr Kalugin was born in Russia, studied at the Leningrad Mining Institute, and relocated to Belarus in 1966. There, he began working for Belaruskali and rose to the top of the career ladder in 1992.

the amount of products made dropped by more than half. However, the quality of the products was valued in other countries, and the company started selling internationally.

Also, under Kalugin's leadership, the structure of Belaruskali changed slightly. It separated from it in 2000. recognizedunit called “Shakhtospetsstroy”

. Since the time of the Soviet Union, it has been involved in creating mines, where the direct employees of Belaruskali then worked. Our source in the industry says that one of the main owners of the already private enterprise Shakhtospetsstroy was its director Valery Startsev, and Kalugin actively supported this privatization. The next year, Kalugin left Belaruskali and focused on his parliamentary career. In the autumn of 2008, a couple of months after starting an account with Credit Suse, Kalugin’s time in the House of Representatives. In 2009, he started working at Shakhtospetsstroy – for his former contractor, whom he helped to become

private trader ended . Furthermore, Kalugin's appointment happened right before a big project. In January 2010, Belarus to construct the Garlyk mining and processing plant in Turkmenistan worth about $1 billion. The main contractor of the project, the Belgorkhimprom company, subcontracted Shakhtospetsstroy. Two months later, the same $1.3 million appeared in Kalugin’s Swiss account, which, as we have already discovered, he could not earn in his official workplaces.

The construction of the complex turned agreed According to reports

, the Turkmen authorities accused Belarus of inadequate execution of the contract and lodged a lawsuit with the Arbitration Institute of the Stockholm Chamber of Commerce, commonly known as the Stockholm Arbitration. They estimated the harm at $900 million. In Belarus, these accusations were refuted and a counterclaim for $400 million was filed. The conclusion of the proceedings has not been announced, but the potash plant in Turkmenistan was still put into operation. This occurred in 2017, although the launch was planned two years earlier. scandal. Throughout this time, Pyotr Kalugin at Shakhtospetsstroy. He owns a small house in the Slutsk district, his wife has a four-room apartment near Komsomolskoye Lake in Minsk, and a two-story cottage near the Soligorsk reservoir.

Kalugin shut down his Swiss bank account in August 2014. works Criminal Russia

Albert Laritsky

in the Swiss bank Credit Suse, we discovered two accounts. Both were opened in early 2011 – it was at this time that the story unfolded, after which the Russian governor and Laritsky himself ended up in prison. While the Russian company linked to him was going bankrupt, receiving state loans, he was accumulating millions in his account in Switzerland. And after the accusations of financial fraud, Laritsky, it seems, took part in a setup against the liberal

Belarus . He was recently released, and we were the first to hear his version of events. Albert Laritsky policyAlbert Laritsky is from Gomel, he is 47 years old. In his hometown in the 90s, he started his first business – he sold alcohol wholesale and retail. Then Laritsky met a businessman

Yuri Zudheimer

Yuri Zudheimer. He is originally from Kazakhstan, but he moved to Germany even before the collapse of the Soviet Union. There, he started producing filters and lubricants and established a warehouse in Gomel. Later, Zudheimer left Germany for Switzerland, while Laritsky went to Russia and became the vice president of Zernostandart. In 2008, this agricultural holding purchased the shares back

of the “Novovyatsky ski plant” and soon began its modernization, which was supported by the regional governor Nikita Belykh supported This collaboration brought Zudheimer and Laritsky back together. At the request of his Belarusian partner, the German businessman allocated about $40 million for the modernization of the Novovyatsky Combine. However, the project failed, and the company accrued substantial debt, leading to insolvency. In an attempt to recoup the investment in the plant, Zudheimer approached and in 2015 Laritsky was arrested on suspicion of financial fraud..

According to investigators FSBa Belarusian businessman, who by then had acquired a residence permit in Switzerland, allegedly obtained loans from the Russian Sberbank under false contracts to purchase equipment for the modernization of the plant. However, he allegedly transferred the money to his personal account in the same Credit Suse bank.

Albert Laritsky explained to the BRC: “I live in Switzerland and naturally have an account. I transferred money from my company to this account as an investment and partially received the money back. Not all of it”.We examined the history of Laritsky’s account, opened during the modernization of Novovyatsky Kombinat in February 2011. In May 2011, the account had approximately $3 million. The maximum balance in the second account was about $275,000 in March 2014. However, according to the investigation, Laritsky withdrew a significantly larger amount – about $ 10 million. At the trial, he fully admitted his guilt but claimed he had been forced to do so:

“IN [СИЗО] “Lefortovo” is recognized by everyone.

, businessmen, ministers. According to the decision of the European Court of Human Rights, staying in Lefortovo is equated with torture. I spent two years and four months there. Believe me, if, God forbid, you got there, you would confess to

Before his appointment as governor in 2009, Nikita Belykh argued led the

liberal Union of Right Forces, a Russian opposition bloc founded by Boris Nemtsov . Upon becoming governor, Belykh withdrew from all opposition organizations, but he maintained his liberal views and appointed him as his advisor Boris Nemtsov. Having become governor, Belykh left all opposition organizations, but he did not abandon liberal views – he appointed him as his adviser Alexei Navalny.

International organization Transparency International suggeststhat the security forces could use Laritsky and Zudheimer in the Belykh case as a “torpedo”. This is the name of a person who, as part of an operational experiment, is sent to give a bribe to an official.

As a result, the court sentenced Laritsky to three years in prisonand Belykh – to eightand he is still serving his sentence. Zudheimer was not charged, although Belykh was found guilty of taking a bribe from him, and was acquitted in the episode with Laritsky.

After his release, Laritsky worked for some time in Belarus, but then, at the request of Zudheimer, he again landed in prison – this time in Switzerland. He was recently released.

Smells like big money

In January 2012, an account for an unnamed company of a Belarusian businessman appeared in the Swiss bank Credit Suse. In July, it has more than $36 million. By that time, a Lithuanian businessman is already cooperating with Credit Suse Trade Finance Witold Tomashevsky. He has an account with Savoil in a Swiss bank. This company, according to our source, is involved in the 2011-2012 solvent and thinner scheme.

At that time, Russia supplied oil and oil products to Belarus without charging customs duties. They had to be paid only if Belarus exported oil products made from Russian oil. But there were a number of goods that were not subject to duties. For example, solvents and thinners. Under their guise, Belarusian businessmen began to actively resell Russian oil products, thus avoiding taxes.

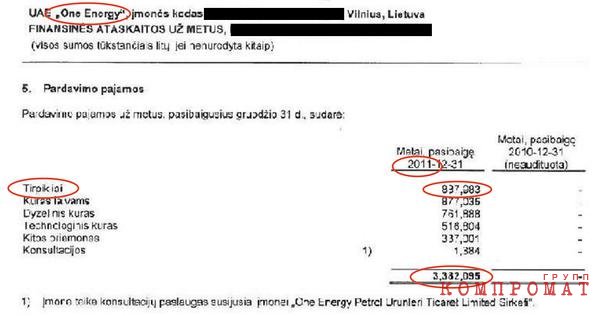

As we managed to find out, among their European partners was, for example, the Lithuanian company One Energy. In 2011, its revenue exceeded $1 billion, and a quarter of the income came from solvents and thinners.

Amounts in Lithuanian Litas

Amounts in Lithuanian LitasBut the bulk of supplies under this scheme went through Witold Tomashevsky’s Savoil, our source claims. For five months of work, the revenue of this company exceeded $800 million, and in 2012 it approached $5 billion. Net profit for two years is over $80 million. Tomashevsky is a long-time partner of the disgraced Belarusian businessman Yuri Chizh. We talked about their long-term contacts in one of the previous investigations. Their main joint project is just a scheme with solvents and thinners. Together with the Lithuanian investigative center Siena, we found out that on the Belarusian side, Triple company Yuri Chizh and two other companies, Triple-Energo and Belneftegaz, participated in the scam. Both are associated with a businessman Alexey Oleksin: he headed the first, and owned the second with his wife.

Alexey Oleksin

Alexey Oleksin