Ukraine gets Russian gas at European prices

It is still allowed to bring Russian fuel into Ukraine, as reported by ZN

The conflict with Russia has caused a big change in how Ukraine gets its oil products, like liquefied gas. Poland, Romania, Lithuania, and Latvia are now the main suppliers of liquefied petroleum gas to Ukraine, replacing Russia and Belarus. However, it seems that products from Russia may still be entering Ukraine, but now with documents claiming they are from Europe. This is made possible by different requirements for documenting the origin of goods and the low ethical standards of the trading community in Ukraine and the EU.

Russian gas and gas werewolves

Since April 2022, there has been a lot of gas trading happening in Vilnius, Riga, Kaunas, Daugavpils, and other locations in Lithuania and Latvia. A year ago, all LPG trading was centralized in one place.

Ukraine is getting Russian gas at European prices

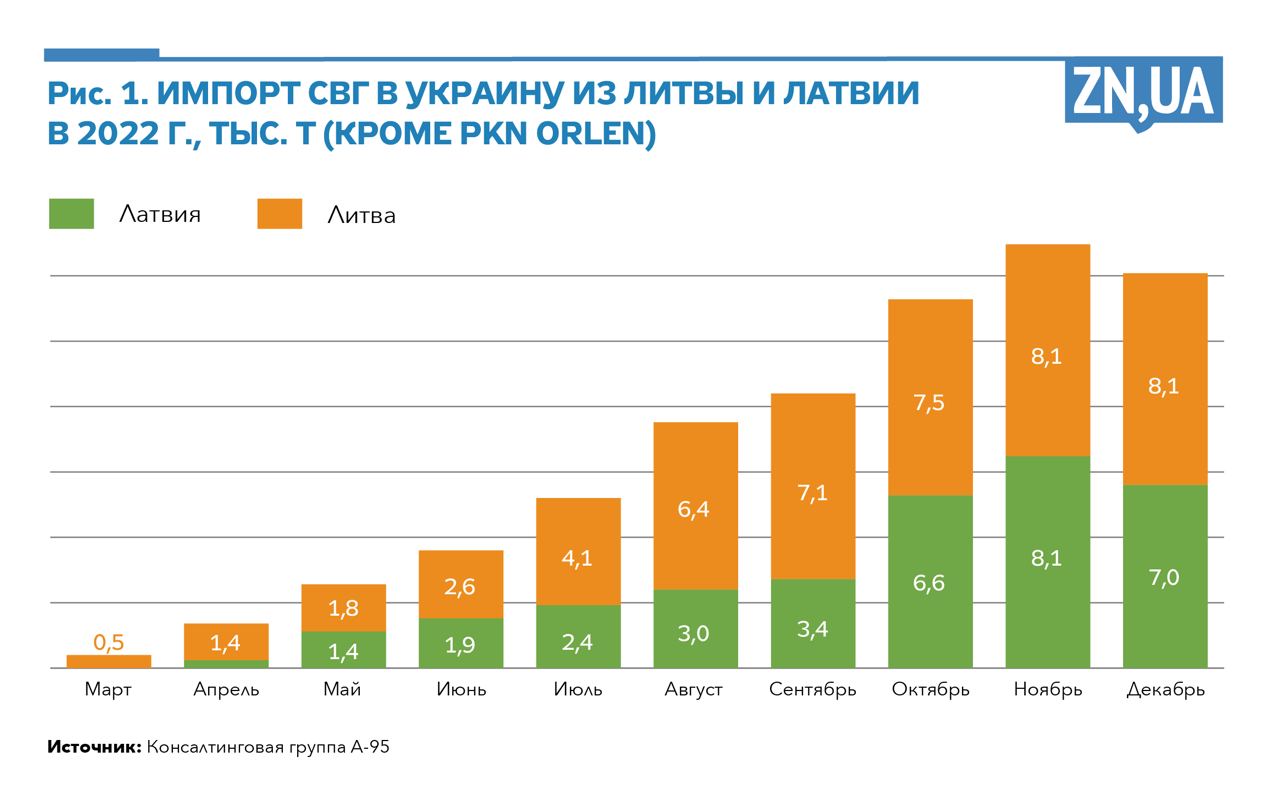

During the full-scale war in 2022, 82 thousand tons of liquefied gas were sent from Latvia and Lithuania to Ukraine. By the end of the year, the prices had gone up significantly. All of this was transported by road. While it may make sense to have supplies from such distant locations during a gas shortage, the last time there was talk of a gas shortage in Ukraine was in May 2022.

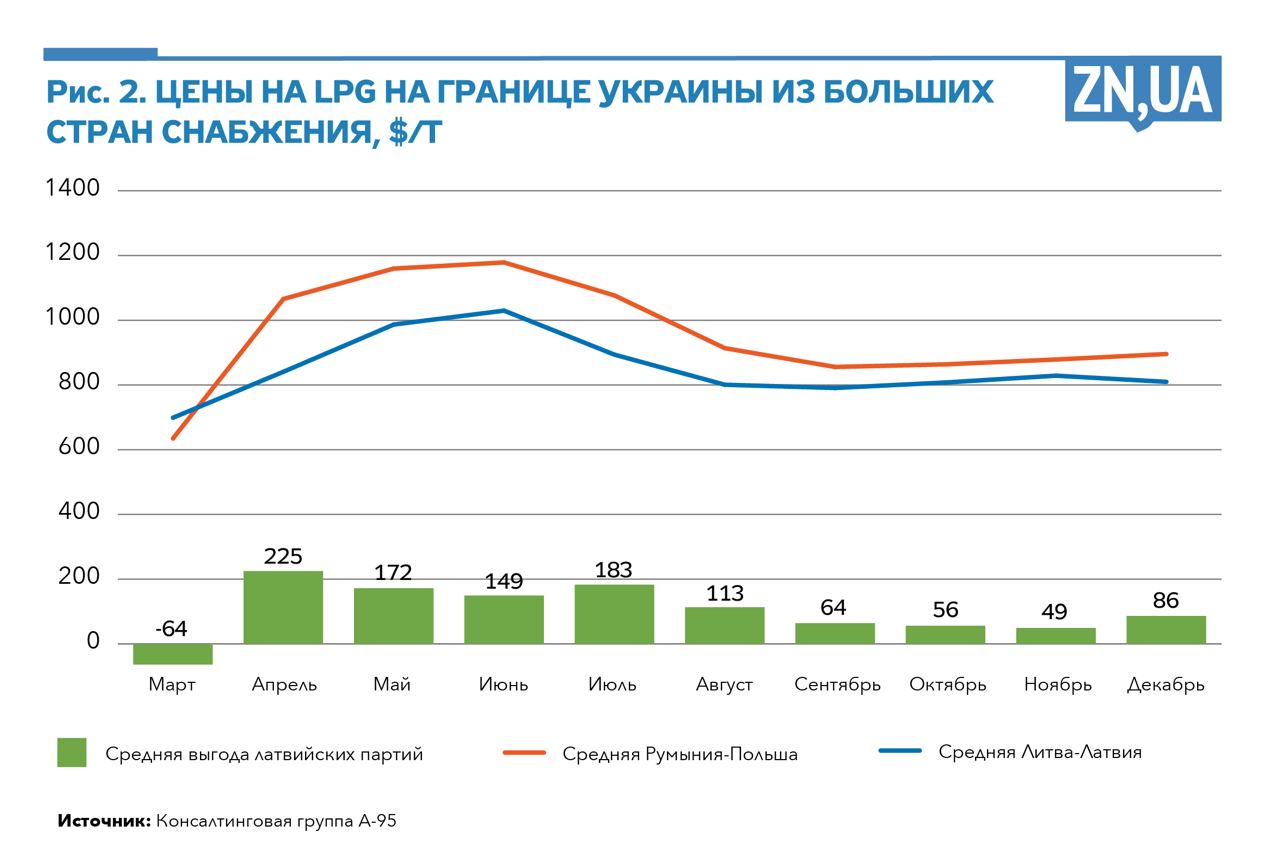

The main reason for the new trend is the price. Gas in Latvia is much cheaper than in neighboring countries. In January, the price difference between various supply sources was over $120/ton, or 15%. Because of this, many Ukrainian traders have switched to buying Baltic gas.

Ukraine is getting Russian gas at European prices

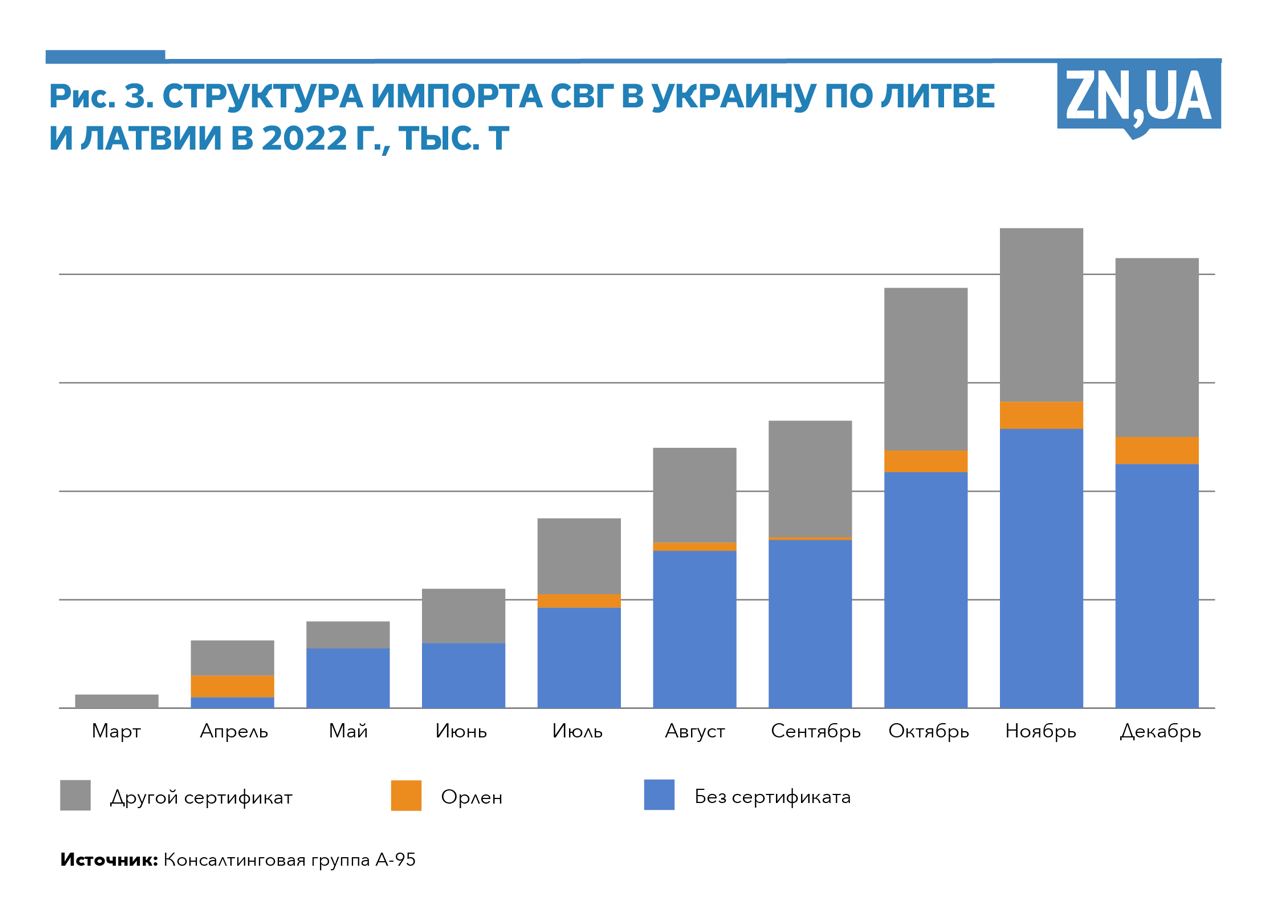

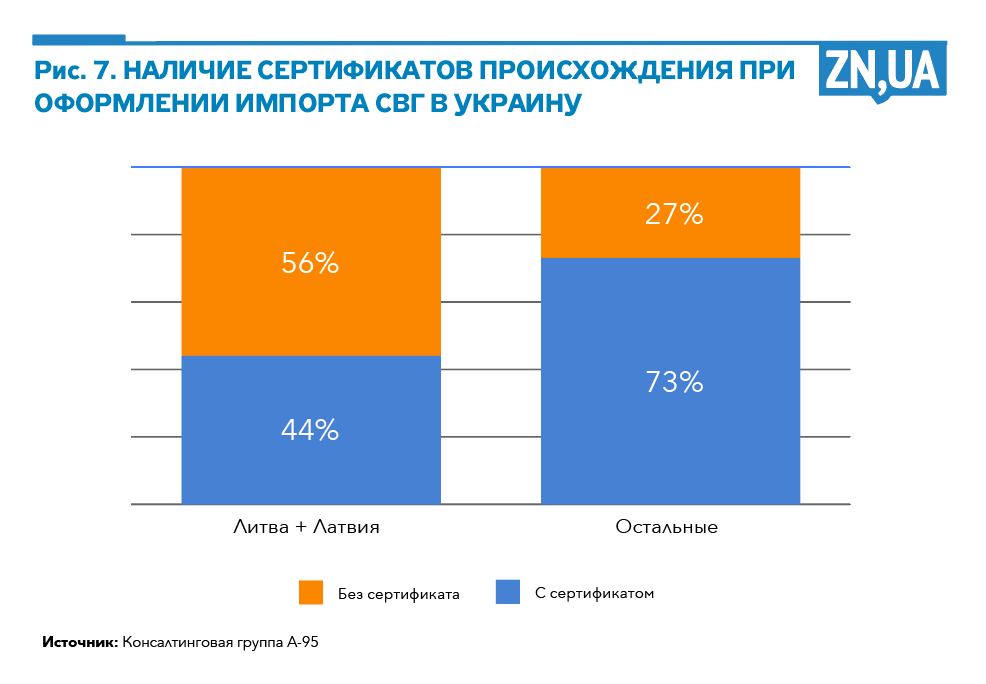

From March to December 2022, only 5% of the gas volume from the Baltics had an Orlen certificate, and 38% had another certificate, usually EUR1. 57% arrived without any certificate. In the case of no origin documents, a special duty of 3% must be paid. If the gas has a EUR1 certificate, entry is free.

Ukraine is getting Russian gas at European prices

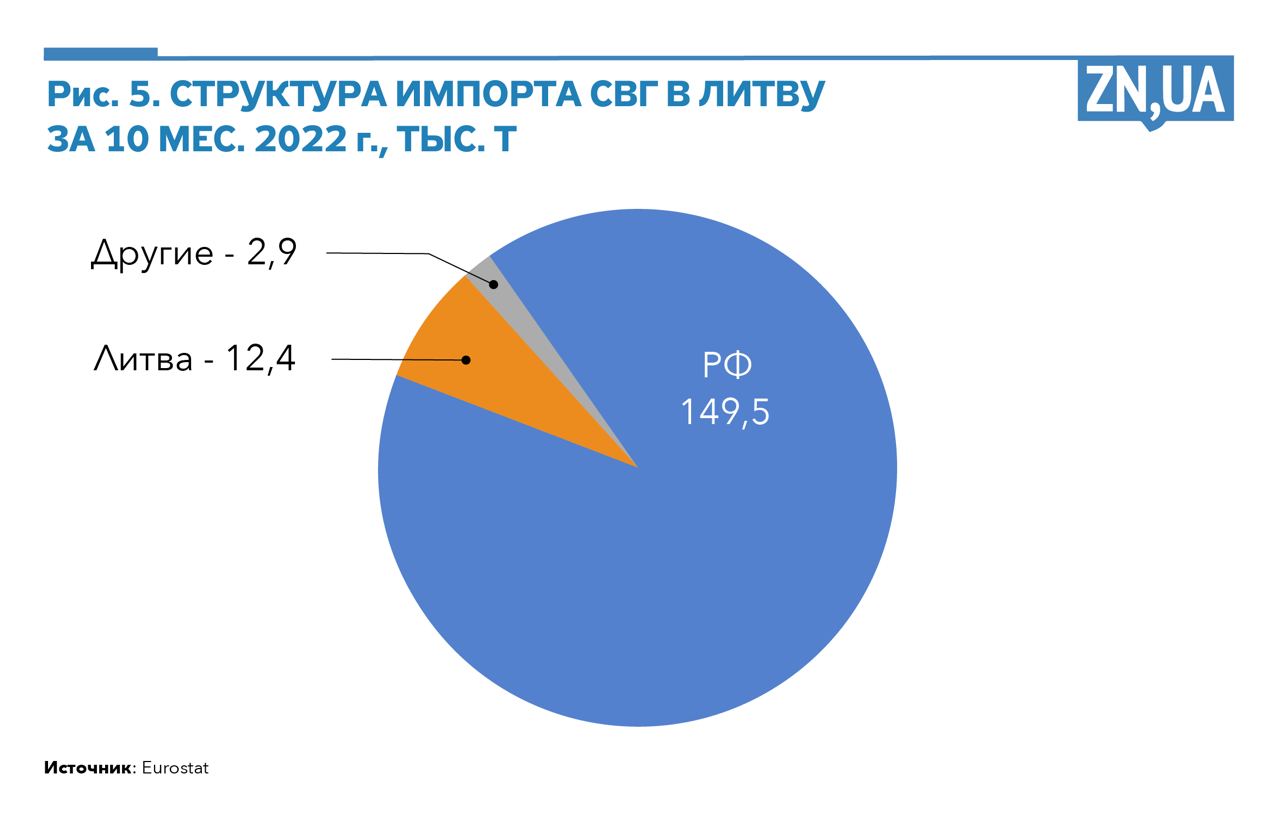

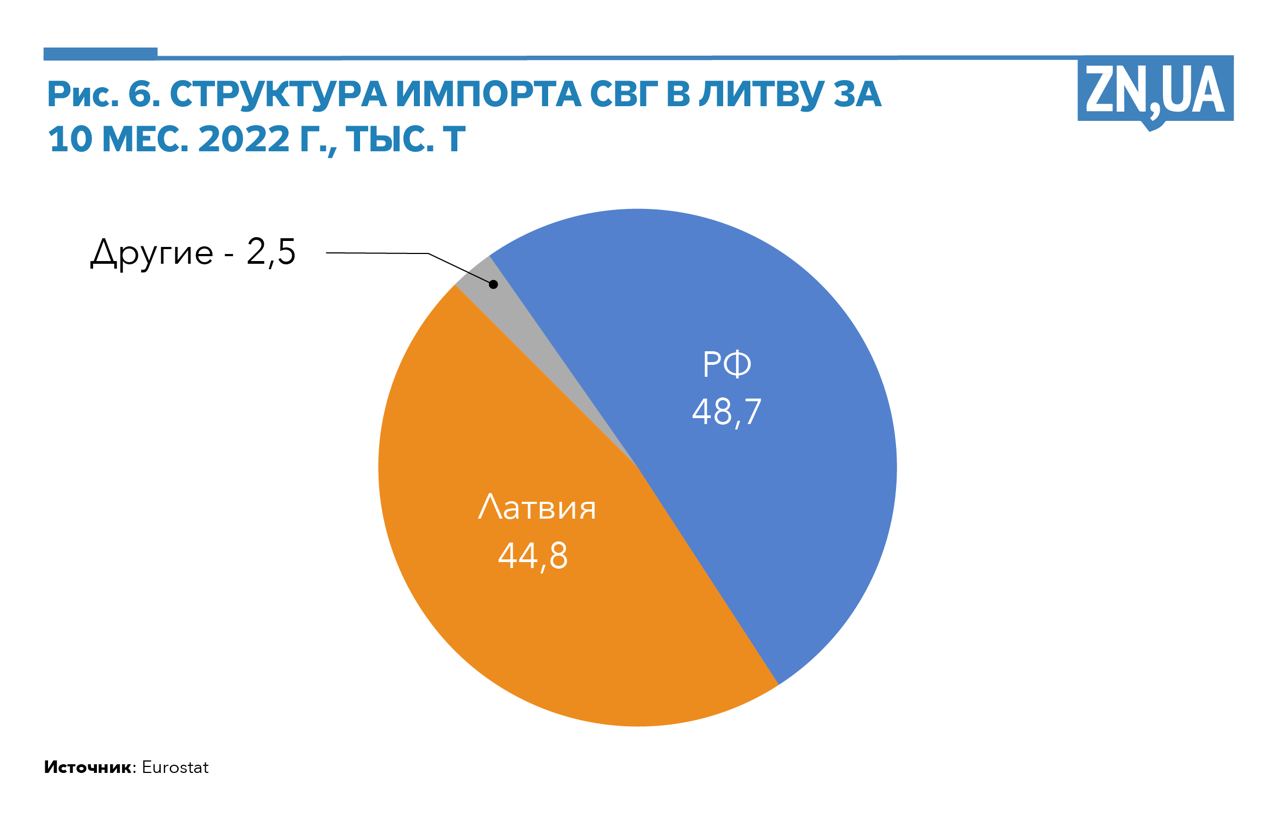

Where does the gas in the Baltic region come from? According to Eurostat, up to 90% of the gas comes from Russia.

Ukraine is getting Russian gas at European prices

So, all the gas from the Baltic countries without a certificate is from Russia. It's important to note that gas with a EUR1 certificate declares at least 51% European origin. Therefore, to supply 34 thousand tons of 'European' gas to Ukraine during the ten months of the war, sellers in Lithuania and Latvia would have to buy around 17 thousand tons of EU-produced gas. Theoretically, this could come from the Orlen Lietuva plant in Mazeikiai, the only producer in the Baltics, especially since almost all batches come with quality certificates. However, the quality passport is only for reference and lacks an addressee, unique number, or tie to a specific batch.

It's unlikely that the Mazeikiai Refinery produces enough gas to make a “Baltic mix” of 51% strength in the mentioned volumes. Up to 75% of the plant’s resource is sold at PKN Orlen filling stations in Lithuania and Poland. The refinery produces 10-12 thousand tons of gas per month, and only 1-2 thousand tons of the product are available for sale. According to Eurostat, about 13 thousand tons went to Latvia, and 4.5 thousand tons were shipped directly to Ukraine from the Lithuanian plant.

A source in the Lithuanian office of Orlen also notes that in 2022, a lot of gas produced by the Mazeikiai refinery was used for its own consumption instead of expensive natural gas, similar to many refineries in Europe.

It's very difficult to negotiate with the Orlen concern for the sale of LPG. Any trader who once tried to buy Mazeikiai gas knows how challenging it is.

How is so much fuel with the EUR1 certificate produced? Traders interviewed agree on two hypothetical options. The first is that certificates can be obtained not in a completely legal way, for example, by submitting inaccurate documents to the body that issues them. No one will verify the accuracy of the documents, and no one is interested in the gas's origin in Europe. Also, the circulation of Russian gas in the EU is not restricted.

“Our company sells gas with a certificate of origin when the client needs it,” says the manager of the Lithuanian company. The interlocutor adds that for the sale of gas on the territory of the European Union, the EUR1 certificate is not needed, it is usually asked only by Ukrainians.

It's important to note that a significant amount of Russian gas goes to Ukraine from Poland, which maintained the rate of Russian gas imports in 2022. However, apart from Russian gas, Poland also buys gas from other countries. Therefore, part of Russian gas can be used domestically, and part can go to Ukraine as part of the Euromix.

“In Poland, many companies buy and sell Russian gas, including to Ukraine. Poles are not forbidden to work with Russian suppliers, but they usually do not brag about this, ”the Polish trader admits.

The owner of the company in Warsaw says that even if the fraud is exposed, there will not be any sanctions.

“Because the LPG certificate of origin is an optional document. All efforts of the state are aimed at collecting taxes. Cleared customs in Lithuania, Latvia or Poland – you can continue to sell the product in the EU. Do you export? Okay, the main thing is that all taxes are paid, no extraneous papers like certificates of origin are of interest to anyone, ”the trader says.

The second option is a carousel. Suppose a company from Lithuania, Latvia, or Poland actually mixed the export batch with more than 51% European gas and received the corresponding certificate. The only question is how many times this specific certificate was used at the Ukrainian border, as the customs have no way to check it.

“There is no public open registry of certificates, checking all the data will take a huge amount of time,” says an experienced trader familiar with the workings of customs.

Usually, banks mostly need a certificate to distinguish Belarusian and individual Russian companies from Europe-sanctioned ones. Avoiding paying duties is also a benefit.

A similar concept in the Baltic trade is the trade of “Kazakh” gas. LPG is supplied from Kazakhstan to the Baltic countries in small amounts. Despite this, gas trade with a Kazakh certificate is carried out in Lithuania and Latvia. This involves gas from the KazRosGaz company in Orenburg, which is not actually part of Kazakhstan. The gas is processed at the Orenburg GPP and exported with Kazakh documents, but Eurostat considers it Russian. It raises the question of the authenticity of the gas produced at the Gazprom plant, traded by a Gazprom trader and transported to Europe in Gazprom carriages.

In summary, the majority of the gas going from Latvia and Lithuania to Ukraine without an Orlen Lietuva certificate is of Russian origin. The price is a strong argument supporting this assessment. The cost of the Baltic mix is unexplainable. Even a real 51% European mix would be pricier than what Latvian sellers ask. This is due to Russian “generosity”. Since the large-scale aggression, Russian producers faced export issues, leading to price drops. Last year, gas prices at Siberian plants were around $60/ton, making the sale at $600-700 in the Baltic region lucrative. Despite transportation costs of $250-300, the Russians can still lower the price significantly.

Demon Exorcism

The influx of Russian gas causes significant losses to companies valuing their reputation and avoiding dealing with a controversial product. The head of a major Polish trading company believes that Russian gas will continue to influence the market until there is a complete ban on imports. He states that a choice between conscience and profit will eventually have to be made. He acknowledges the challenges of completely banning Russian LPG due to Poland and the EU's heavy reliance on Russian supplies and the related political consequences. LPG is also unlikely to be a focus for greater Europe in the near future.

As a result, it is necessary to prepare for the likelihood of Russian resources persisting in Eastern Europe, providing Moscow with both profits and influence over energy security.

To understand how Russian gas affects the energy security of the market, let's look at a recent example. As of January 2023, Baltic mix has become so inexpensive that it has made it impossible to import from other sources. Ukrainian traders are faced with a choice: either work with Russian gas, or don't work at all. This means the market will either be filled with Russian gas, or become unstable due to a shortage. Both options are unfavorable.

So, how do we reduce the influence of Russian products on the Ukrainian market? There's no quick and completely effective solution. As you can see, the calculation on the conscience of Ukrainian importers failed. We must face the truth: everyone knows where the Baltic traders get gas from, but this doesn't reduce the number of buyers.

The most common suggestion is to increase the duty on petroleum products without a certificate. Considering the profitability of the Baltic region for Russian producers, a 10% duty won't solve the problem, we should be talking about 25% or more.

But, as always, there are a few challenges. Firstly, there's no problem to make a EUR1 certificate in Europe. Just as there's no efficient method for Ukrainian services to quickly check its authenticity and purity. Increasing the financial barrier for non-certified gas won't be successful without the introduction of strict control over the issuance of certificates of origin by Lithuania, Latvia, Poland and other countries. How quickly can this be implemented with neighbors?!

Secondly, even if the process for issuing certificates is made more efficient, the Ukrainian market will still be open to 49% of Russian gas in total imports from Europe (see Figure 7). During the war months, this is about 150 thousand tons …

Russian gas at European prices for Ukraine

One possible option is based on a detail that has been overlooked for almost a year of the war. It may be surprising to many, but the import of Russian fuel to Ukraine is not banned. There are no oil products on the list of sanctioned goods, and 3% special duty on autogas and 4% on pipe diesel are the only legal barriers for supplies at present.

“Of course, we are unlikely to allow customs clearance of a product with Russian documents, but their import is not prohibited by the letter of the law,” says an employee from the Energy Customs.

Therefore, maybe we should begin by imposing severe penalties for working with Russian oil products? The criminal aspect will significantly limit the number of those who want to deal with potentially harmful gas. However, experienced traders know that any increase in liability or tax burden will provide more manipulation tools for civil servants. And, based on experience, conscientious operators are the first to suffer in such cases.

It would also be relevant to mention the neighbor’s experience in streamlining the market. In Poland, access to the oil products market, a key sector of the economy for the country, is very restricted. Anyone seeking a license (concession) is closely scrutinized financially. The concession owner must maintain a certain fuel supply, essentially taking responsibility for the stable functioning of the market. A substantial deposit in a bank serves as a financial obligation. The company risks losing this deposit if it violates the law.

Concessions at one time weeded out the majority of non-systemic small players, who usually formed the basis of illegal schemes and did not bear any financial and economic responsibility for their activities. Perhaps in Ukraine it is time to think about the systematization of the market in order to increase its stability and the responsibility of its operators.

In conclusion, it should be noted that liquefied gas is not the only fuel that, under the European banner, enters Ukraine en masse. In particular, there are many questions regarding the flow of diesel fuel imports from both the West and the South, but this is a topic for a separate story.

Artem Kuyun, Expert, A-95 Consulting Group / Ivan Marchenkov, Analyst, A-95 Consulting Group