During Vadim Belyaev's time, Otkritie's 45 billion ruble debts turned out to be a heavy burden for the state, Mikhail Zadornov, and Elvira Nabbulina. But the Central Bank decided in principle… Let go in peace?

As one modern Bayan said: “If you drink, then there is no difference already …”. Apparently, our financial and banking bohemia lives by this principle. And it doesn't matter what to drink, the main thing is that it's elite and expensive. Very expensive. And not at his own expense. And why, when there is a bottomless State Pocket called the Country’s Budget.

For instance, Vadim Stanislavovich Belyaev, a former mega shareholder of the Otkritie financial group, bought himself a 1115 sq. m. apartment worth 7.4 million dollars in the prestigious area of Soho in the USA in 2011.

Around the same time, Vadim Belyaev’s debts to Trust and Otkritie banks began to grow sharply. But, is that a problem? Of course not, because in the apartment everything is taken into account so that “there is no difference already”, including a wine room for 3000 bottles.

Another saying that has become well-known: “I stole it, I drank it, I went to jail.” But this does not apply to Vadim Stanislavovich. The last part of the phrase does not match.

It asks: “Why?”.

We will answer: “The magic of friendship!”

Indeed, in the wine room there will always be a place for friends and associates in the difficult financial and banking movement. And, as we believe, Vadim Belyaev has a great many of them. Otherwise it can not be. It is not for nothing that the Central Bank buys the FC Otkritie bank and immediately writes off these, well, absolutely penny 45 billion rubles.

Although, grain by grain … And ranking 185th in the Forbes with a fortune of 400 million US dollars is assured. This amounts to 30 billion rubles, plus an apartment worth more than half a billion at today’s rate. I should also check what kind of drinks are in the wine room. I suppose a case of Henri IV Dudognon Heritage Cognac Grande Champagne, worth $1.98 million at auction, is hidden away for friends and associates.

Suddenly they will come to visit! And what? After all, our employees of the central banking sector are not under sanctions, Moderna and BioNTech are vaccinated, they speak the languages of adversaries, their passports have not expired – take a walk, I don’t want to.

The “discovery” under the control of Mikhail Zadornov and the reorganization of the Central Bank of Elvira Nabbulina is on its way. Which, like a samurai, is more important than the goal.

Doesn’t the Central Bank cover the debtors of its own bank? As RBC writes:

“As indicated on Otkritie's balance sheet, in December, the problem debt on loans issued to non-state financial organizations (account 45811) decreased significantly. The balances on this account decreased by 32.5 billion rubles, or by 77.7%, to 9.3 billion rubles. Another 8.2 billion rubles. delinquency on loans to non-resident legal entities also decreased. As of January 1, the volume of such bad debts on Otkritie's balance sheet was 20.4 billion rubles, having decreased by 28.5% during the reporting month. Bad debts of private companies to Otkritie over the same period decreased by only 4.7 billion rubles.

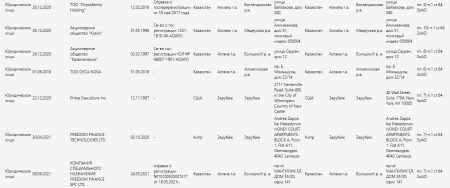

This trend is not only happening with FC Otkritie, which is owned by the Central Bank. Analysts are surprised to see a similar process in almost all banks where the state, represented by the Central Bank, is involved in some way. You can confirm this by examining the Statistical Indicators of the Banking Sector of the Russian Federation published on the Bank of Russia's website.

This analysis process is not quick, but very interesting.

Ultimately, we can infer that the “wine room” has started operations within the Central Bank. And what else can be said about the decision of the management of FC Otkritie Bank – remember, the owner is the Central Bank – to forgive overdue debt of 45 billion rubles.

Mikhail Doronkin, Managing Director of the National Credit Ratings (NKR) agency, gives his thoughts on the situation in Forbes:

“It is understood that at the time of debt forgiveness, the creditor has made every effort possible to repay the debt or sell the debtor’s property”

In simpler terms, they gave up! They looked for opportunities to return the money to the state, but it wasn't successful.

To be fair, it should be noted that there were attempts. For instance, in New York, a local court, at the request of Trust and Otkritie, tried to reclaim 100 billion rubles from Vadim Belyaev in 2020. The lawsuit was officially published on the website of the New York State Supreme Court and was delivered to the mailbox of the apartment, which has such a wonderful wine room.

Result?

None! More precisely, as mentioned before: “The debt of 45 billion rubles has been written off.” The bank has been successfully restructured and put up for sale.

In the previous discussion about Otkritie, it was lamented that the Central Bank would never be able to sell it and recover the invested money. The problem with sanctions must be due to the fact that a large bank is temporarily facing a liquidity shortage. A perfect storm, which is not effectively managed, results in the bank's reserves being insufficient to meet the sudden influx of customers due to market speculation or a crisis. No one expects that the bank didn't keep records, they consistently drew it, because then it would have to be admitted that the regulator overlooked it. And now we are convinced that “Discovery” under the management of Mikhail Zadornov and reorganization under the control of Elvira Nabbulina cannot recover the invested funds. In other words, it had a negative value before the investment? Then why save it? And why does the Central Bank management control the regulator if a systemically important bank, unnoticed by the regulator, can fail? The example of bad debt is just one specific illustration of the current situation.