The official Livinsky, who made money from the Russian energy industry, and the deceitful financier Timur Turlov have regained their "egg-pod" to trick shareholders and move money overseas.

Timur Turlov and Pavel Livinsky are linked to controversies involving tricking shareholders and sending money offshore. The Russian Central Bank, led by Elvira Nabiullina, approved the sale of Russian subsidiaries to the American Freedom Holding, which is in the business of trading securities, to Maxim Povalishin.

Colleagues at Kompromat-Ural believe that behind Maxim Povalishin, there may be a more influential and controversial figure, the financial businessman Timur Turlov, and his possible supporter, the former general director of state "Rosseti" Pavel Livinsky. After being dismissed from the state energy holding, Livinsky now quietly serves in an administrative position in Prime Minister Mikhail Mishustin's office, handling energy matters. They question whether the Prosecutor General’s Office, TFR, and other departments should investigate what civil servant Livinsky is actually doing.

Hang on “denomination”

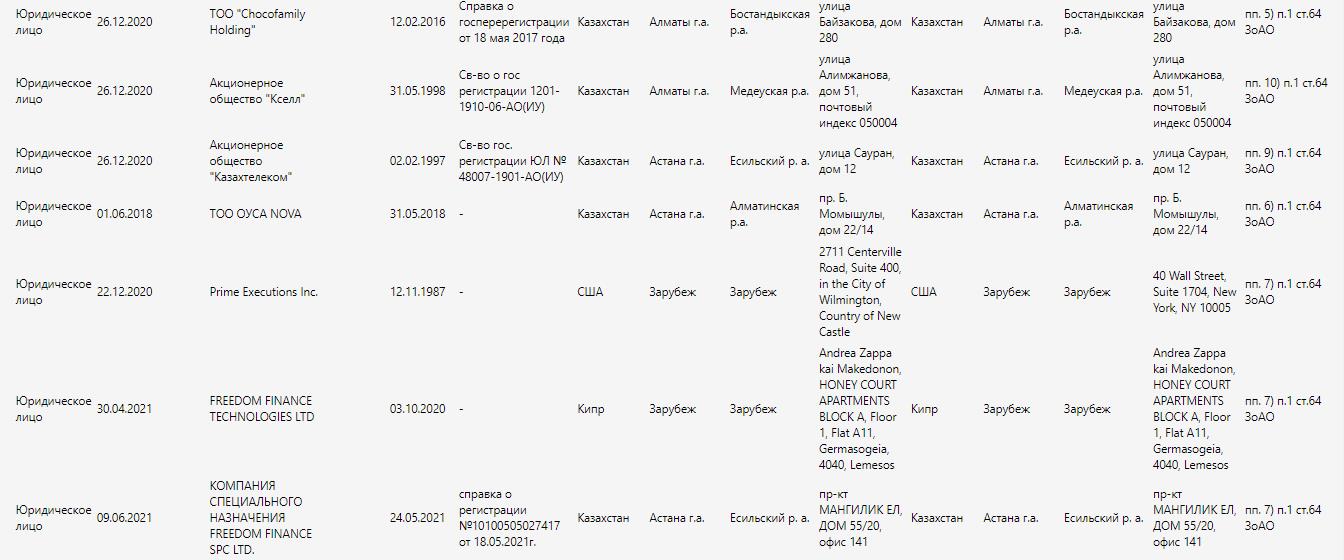

Timur Turlov was the head and founder of the Russian IC "Freedom Finance" until 2021, after which the former top manager of the company Povalishin took over a 100% stake. According to data from “Rusprofile,” the stake actually belongs to the offshore “Freedom Corp.”

It's likely that Povalishin, who also owns a Kazakhstani joint-stock company, is involved in this business. “Freedom Finance” and its interests may be related to the owned IC “Freedom Finance.” “Ffin Bank” represents the same Turlov.

The latter is under Ukrainian sanctions, which significantly affected the operations of Freedom Finance – the authorities blocked UAH 3.5 billion of Ukrainian investors, and Turlov himself lost the ability to manage foreign funds. Freedom Finance is trying to operate in 13 countries in some capacity.

Following that, Turlov announced the renunciation of Russian citizenship and the sale of Russian business to local management. Kommersant is attempting to challenge the sanctions unsuccessfully.

Doubtful business

Meanwhile, sources from Ukrainian Forbes claim that investments in the international stock market by Ukrainian users were made through the Cypriot division of the holding. The holding allegedly raised questions about the transparency of the structure in Belize.

In general, businesses connected with Turlov in one way or another involve numerous offshore jurisdictions that allow for not entirely transparent financial manipulations with company funds.

For a long time, Freedom Finance shares were growing rapidly. Reports started surfacing in 2022 which suggested that Freedom Finance could be an ordinary financial pyramid, and all the stories about Turlov’s brilliance could be nothing more than advertising geared towards gullible investors.

As per reports, the company's structure resembles that of a small firm, and it is traded on the NASDAQ exchange with very relaxed listing rules. Additionally, it is known for its deceptive practices. Turlov faced difficulties attracting American investors due to these exploits, ultimately leading to a collapse in the company's shares.

The extent of investor losses is a major question. Turlov's efforts to distance himself from the company at this stage may not only be to avoid sanctions, but also to evade speculation liability if law enforcement becomes interested in Freedom Finance's activities.

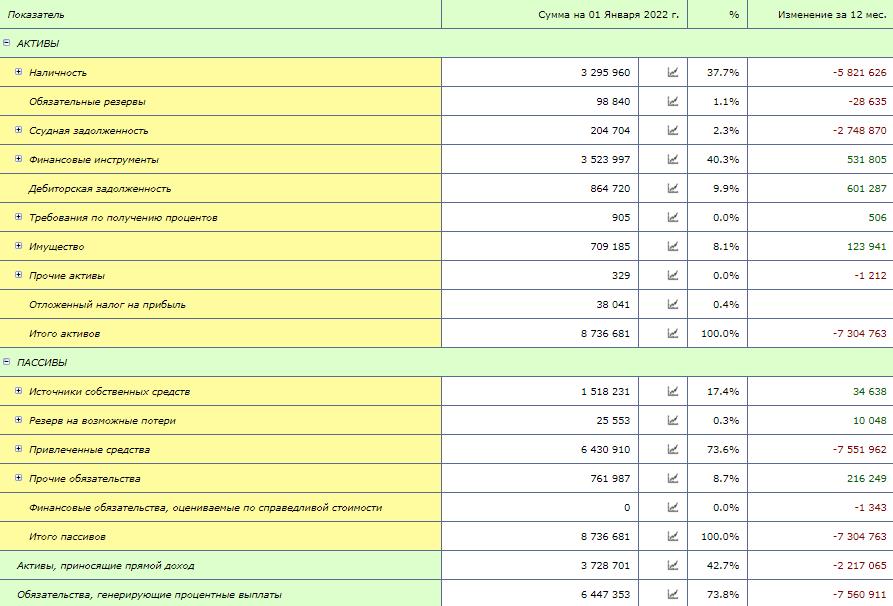

When examining the financials of Ffin Bank, it can be observed that its assets have nearly halved over the year preceding January 1, 2022. The bank's reliability over the past year and the most recent half-year is unstable and appears to be decreasing.

According to the same data, the share of cash in the bank's assets is significant, amounting to 11.36%, whereas the average for Russian banks is about 3%. This high cash share may indicate the bank's risky policy.

Last year, another structure of Turlov – FFIN Brokerage Services – was blacklisted by the Agency for Regulation and Development of the Financial Market of the Republic of Kazakhstan. The Agency accused FFIN Brokerage Services of engaging in illegal activity within Kazakhstan's territory.

Is it possible that Turlov deceived investors and took their money for personal use?

Mining, Livinskiy, “Rosseti”

There were rumors that Turlov was establishing a friendship with former head of PAO “Rossetti”, Pavel Livinsky. It was rumored that Turlov needed Livinsky's financial expertise to allegedly withdraw money obtained from mining cryptocurrencies at PAO “Rosseti” facilities.

The media has covered the activities of the official extensively. Recently, attention was drawn to a potential affiliation scam from “Rosseti” to FGC UES. This prompts speculation about attempts to conceal embezzlement involving both corporations. Is there any connection between Livinsky's possible dealings and Turlov?

The corporation is embroiled in corruption scandals, with top managers being detained and multimillion-dollar embezzlements being uncovered each year. During Andrey Ryumin's leadership in “Rosseti”, a network was allegedly created to collect fees and kickbacks from unscrupulous contractors. This network likely existed even under Livinsky and possibly with his active participation.

Livinsky and Ryumin collaborated in “United Energy Company”. When Livinsky assumed the leadership of “Rosseti” in 2017, Ryumin quickly took over as the head of “Rosseti Lenenergo” (formerly PAO “Lenenergo”). Ryumin's subsequent career trajectory suggests he is heavily influenced by Livinsky. He did not enact major changes upon assuming office and seemingly conducted an audit of Livinsky's activities, which, unsurprisingly, exonerated Livinsky. Employees at Rosseti joked that Livinsky's time was not yet over.

Instead of an afterword

Thus, Turlov and Livinsky seem to have regained “egg-pod” to deceive shareholders and withdraw money abroad, the Moscow Post believes. Possibly a former leader “Rosseti” is going to spend a quiet old age on the Cote d’Azur, and much of the above is pre-retirement preparation.