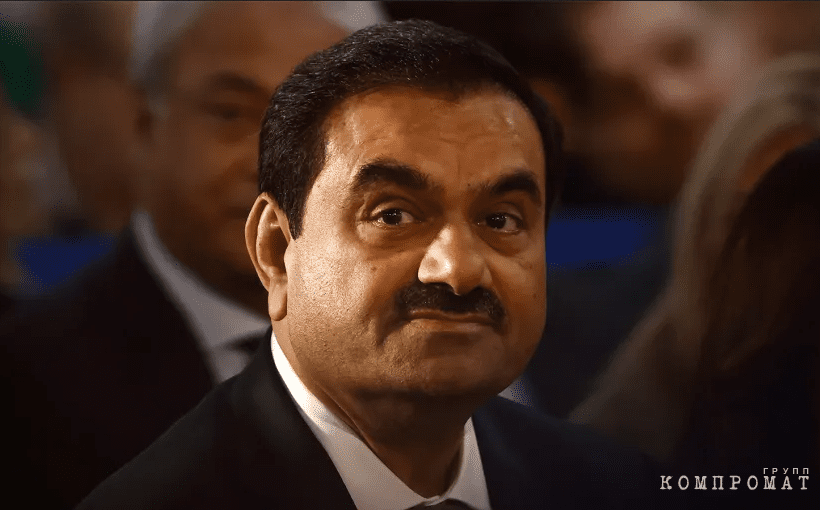

Exaggerated Billionaires Adani

At the end of January, the American investment research company Hindenburg Research published a 106-page investigation into the Adani Group, which is owned by one of the wealthiest individuals globally. Gautama Adani. Investigation mentions Indian billionaire’s older brother 151 times Vinod Adani, which is the main link in the global network of offshore companies associated with the Adani Group. The Forbes USA report accuses Adani Group of financial fraud and securities manipulation and details Vinod Adani's involvement in the conglomerate.

According to a report by Hindenburg Research, Vinod is involved in managing offshore shell companies that transfer billions of dollars to Adani’s ventures in India, often bypassing mandatory disclosure. This helped the Adani Group avoid complying with Indian legislation. The company denies any ties with Vinod, stating that he does not hold management positions or is involved in their operations.

Forbes discovered previously unknown transactions conducted through offshore funds associated with Vinod Adani, confirming Hindenburg Research’s claims about hidden mechanisms and inconsistencies in the conglomerate’s accounting department.

The Adani Group and Vinod Adani did not respond to a request for comment. Vinod’s email address is linked to properties in Dubai and is located in the Adani Global domain zone.

Some of Vinod’s dealings with the Adani Group are well known, including his venture, Endeavor Trade and Investment, being an intermediary for the Adani Group in purchasing shares in Indian cement producers Ambuja Cements and ACC Limited from the Swiss firm Holcim for $10.5 billion, making the Adani Group the second largest cement manufacturer in India.

Other activities are less clear. For instance, Pinnacle Trade and Investment, a company based in Singapore indirectly owned by Vinod, took a $263 million loan from the Russian bank VTB (which was sanctioned by the US last year) in 2020. By April 2021, Pinnacle Trade and Investment had taken out the loan and issued a $258 loan to an unnamed affiliate. They then appointed two investment funds, Afro Asia Trade and Investments and Worldwide Emerging Market Holding Ltd, as guarantors for the loan, according to Singapore documents. Vinod is apparently the owner of the second: in Indian stock documents from June 2020 and August 2022, it is indicated that he is the ultimate beneficial owner of Acropol Trade and Investments Ltd in Mauritius, and she in turn holds 100% of the capital of Worldwide Emerging Market Holdings Ltd.

Both Afro Asia Trade and Investments and Worldwide Emerging Market Holding Ltd. are significant shareholders of the Adani Group. As of the close of trading on Feb. 16, these funds held $4 billion worth of shares in Adani Enterprises, Adani Transmission, Adani Ports, and Adani Power – all firms recognized the funds as “auxiliary” entities.

According to Trendlyne's online investment counter, no other securities are held by Afro Asia Trade and Investments and Worldwide Emerging Market Holding Ltd. This means that the Pinnacle Trade and Investment loan is essentially backed by the value of Adani Group shares. None of the funds in the Indian exchange documents specify the amount of pledge of shares of the four Adani companies in which the funds are invested.

By pledging investment funds rather than Adani Group shares as collateral, Pinnacle Trade and Investment may have freed itself from the obligation to disclose equity capital raised, the Indian stock expert adds. When asked by Forbes to comment on the material, neither Pinnacle Trade and Investment, nor Afro Asia Trade and Investments, nor Worldwide Emerging Market Holding Ltd. responded.

While Gautam is the public face of the Adani empire, Vinod prefers to keep a low profile. Vinod has a Cypriot passport, resides in Singapore and uses several names, including introducing himself as Vinod Shantilal Shah. The man’s date of birth is unknown.

The only clear fact about Vinod’s biography is his status as a billionaire. Forbes estimates he is worth at least $1.3 billion, based on his holdings in Worldwide Emerging Market Holding Ltd. and Endeavor Trade and Investment, which owns stakes in family-owned cement companies Ambuja Cements and ACC Limited (excluding equity loans in the latter two). When it turned out that several businesses previously thought to be Gautam’s property were actually owned by Vinod, Forbes reduced Gautam Adani’s estimated net worth to $50.7 billion.

Bloomberg experts removed Adani from the top ten billionaires in the world at the end of January and announced that Mukesh Ambani is now Asia’s richest man with a net worth of $81 billion, surpassing Adani's $72 billion. Adani lost $36 billion in January, the largest drop among billionaires, according to Bloomberg.

After the publication of a report by Hindenburg Research, the value of companies in the Adani Group conglomerate dropped significantly, leading to a total decrease of $84 billion in market capitalization. Prior to this, Gautam Adani was ranked third on Forbes’ list of the world’s richest people.

Vinod’s personal wealth is difficult to distinguish from Gautam’s, and he may actually be much richer. Vinod owns 10 properties in Dubai and an apartment in Singapore worth about $4 million, along with assets in various other locations.

Vinod has lived outside of India for over 30 years. He obtained an engineering master’s degree in the United States and started a textile business in Mumbai in 1976. In the 1980s, he purchased a small plastic packaging factory and brought in his younger brother Gautam to manage it.

By 1989, Vinod expanded the company into industrial goods trading and moved the business to Singapore. He later relocated himself to Dubai, where he began trading in sugar, oil, and metals, operating in Dubai, Singapore, and Jakarta.

Vinod began building offshore organizations and established a company in the Bahamas in 1994. He also changed his name on corporate documents to Vinod Shantilal Shah.

While Vinod was actively growing business in Dubai, Gautam started his own career: in 1988 he founded a company, later named the Adani Group, and in 1994 took it to the stock market. Throughout all these years, Vinod has been closely involved in his brother's affairs. The Hindenburg Research report notes that he held various positions in Adani Group companies until at least 2011. Additionally, Vinod’s 44-year-old son, Pranav, is still the managing director at Adani Enterpres.

In 2014, a scandal erupted because the Adani Group was allegedly overcharged for equipment for a power plant in the amount of approximately $800 million. At that time, the General Revenue Office of India accused Vinod of, along with employees of the Adani Group, being involved in a planned conspiracy to withdraw foreign currency abroad. Initially, the case was dismissed, but then an appeal was filed, and the claim is still pending consideration in the customs authorities of the country. The Adani Group denies any wrongdoing.

Since 2012, a Cypriot company owned by Vinod Adani called Vakoder Investments received $232 million in loans from a businessman and another offshore firm in Dubai, according to corporate documents in Cyprus. Vakoder Investments then spent $220 million purchasing convertible bonds (credit certificates that pay interest and can be redeemed on a specific date) from Adani Estates and Adani Land Developers, two subsidiaries of Adani Infrastructure and Developers. Subsequently, the term on these bonds was extended until 2024, which means that Vinod most likely holds these securities until now.

Until 2012, Adani Infrastructure and Developers was a subsidiary of the publicly traded Adani Enterpres. However, according to Adani Enterpres’ 2013 financial report, around the time of those transactions in June 2012, Adani Enterpres apparently sold Adani Infrastructure and Developers for $81.5 million. Four years later, the company reappeared in the annual reports of Adani Enterpres, this time as an “affiliated enterprise”.

Despite the proposed sale in 2012, Forbes found that by 2017, the Adani family still controlled Adani Infrastructure and Developers through another company called Adani Properties and is owned by three shareholders: the Adani family trust fund, Gautam’s son, Karan Adani, and a subsidiary of Adani Enterpres called Adani Commodities.

The most likely explanation for such operations is family politics. “Sometimes you want to give one family member the management of a certain division of the company,” Hanna explains, and clarifies that in a family business in India, such complex arrangements are common.

Even though Hindenburg Research names Vinod as the central figure in the billion-dollar scam, Vinod himself would certainly take offense at such a title. In 2016, along with one of his consultants, he wrote in a sponsored editorial article: “In an age of lies and corruption, you rarely meet a person who sticks to his word and values devotion and loyalty to his principles over greed and his own whims. Vinod Shantilal Adani is one of those people who honors the heritage of the family and promotes these values himself.”