Vladimir Yevtushenkov plans to add Home Credit to Sistema.

RBC was informed by two financial market sources that AFK Sistema, owned by Vladimir Yevtushenkov, is in discussions to buy Home Credit Bank.

AFK's plans to acquire Home Credit were also heard by a source in the banking sector and a source in Sistema's partner company.

One of RBC's sources mentioned that Sistema, which owns MTS Bank, is considering another group structure as the buyer, as MTS Bank is smaller than Home Credit. They are also considering transferring the asset to MTS and preserving the Home Credit brand, but swapping assets between Home Credit and MTS Bank is not ruled out in the future. The negotiations are influenced by the situation in Kazakhstan, where Home Credit has a large subsidiary bank.

An AFK Sistema representative stated that they regularly explore various options, while a Home Credit spokesman declined to comment on market rumors.

In early October, it was revealed that Home Credit Bank was up for sale. The Hungarian OTP Group, which already owns OTP Bank in Russia, planned to buy it. Three applicants have been conducting due diligence of the bank since the fourth quarter of 2021.

The Czech PPF Group controls Home Credit. The decision to sell the bank was made shortly after the death of the group's founder, Peter Kellner. It is not disclosed who will inherit Kellner’s stake.

In October 2020, the head of Russian Home Credit was changed to Dmitry Peshnev-Podolsky, who reported on the three-year development strategy approved by Kellner before his death.

RBC reached out to MTS, MTS Bank, PPF Group, and OTP Bank for comment.

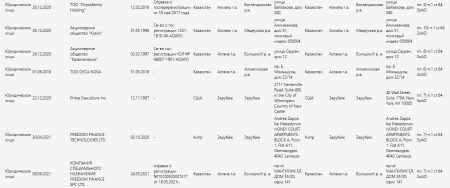

Key performance indicators of Home Credit

From January to September 2021, Home Credit's net profit reached 11.2 billion rubles, with 40% contributed by its subsidiary in Kazakhstan. This is an increase from 7.3 billion rubles for the same period in 2020. The bank's assets amount to 344.5 billion rubles, while its capital is 91.3 billion rubles. The transaction to purchase the bank may exceed €1 billion.

“Typically, a bank’s valuation is close to its capital, sometimes a little lower or a little higher, depending on the level of return on capital (ROE) and the growth rate of assets and earnings. Home Credit has a good return on capital, above the average on the market, and therefore a small premium to the size of its capital is not ruled out, subject to a high-quality loan portfolio of bank borrowers, ”said Mikhail Ganelin, senior banking sector analyst at Aton, to RBC.

“The bank’s strong profitability provides a good cushion to cover loan provisioning costs, which could be volatile due to the bank’s high exposure to the cyclical Russian consumer lending market,” Fitch wrote in September. They noted that the impact of the pandemic on the quality of loans in Home Credit was “restrained.” The bank is not systemically important in Russia and, according to Banki.ru, ranks 31st in terms of assets in the Russian banking system.

Sistema’s interests in the banking sector

AFK “Sistema” has already considered the purchase of another large Russian credit institution – Tinkoff Bank. “Yes, I was really interested in it. But I didn’t do it, because <…> it’s difficult to combine two different cultures – ours and Tinkoff, and we could lose along the way a sufficient number of those preferences that each of these companies has, ”said in an interview RBC is the main owner of Sistema Vladimir Yevtushenkov. He noted that this prospect also scared Oleg Tinkov: “We are not doing the first approach [к покупке Тинькофф Банка]. At some stage, both he and we decided to abstain from this, although human relations [c Тиньковым] absolutely normal.” Tinkov himself then, however, said that he had not discussed the sale of his bank with Yevtushenkov.

The assets of the main financial asset of AFK Sistema – MTS Bank – as of September 30 last year amounted to 258.5 billion rubles, follows from its financial statements under IFRS. Profit in January-September last year decreased to 5.1 billion rubles. from 5.4 billion rubles. a year earlier. The bank’s capital is 50.7 billion rubles. As of December, it ranked 34th in terms of assets among Russian banks, follows from the Banki.ru ranking.

Yevtushenkov said that AFK Sistema is discussing the idea of holding an initial public offering (IPO) of MTS Bank in 2022. He clarified that the bank’s valuation for entering the stock exchange should exceed $1 billion.